How to Buy Down Your Mortgage Rate: A Guide for Potential Homebuyers

As you explore mortgage options to finance your new home, you may come across the concept of a “rate buy-down.” This is a valuable strategy

As you explore mortgage options to finance your new home, you may come across the concept of a “rate buy-down.” This is a valuable strategy

Now that you’ve decided to buy a home and are ready to make it happen, it’s a good idea to plan ahead for the costs

If you’ve been hesitant to list your house because you’re worried no one’s buying, here’s your sign it may be time to talk with an

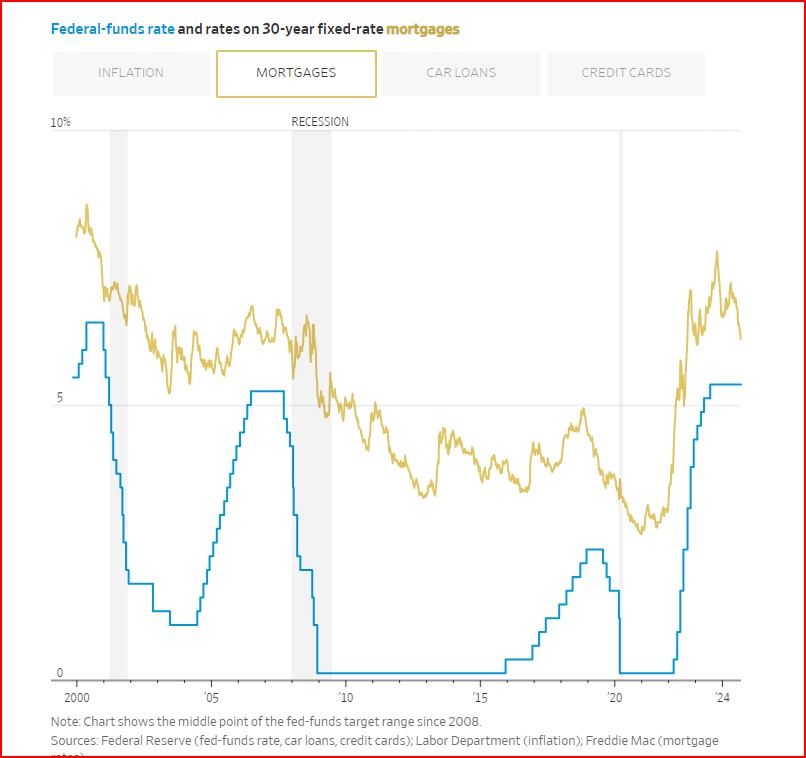

The financial landscape has shifted dramatically with the Federal Reserve’s 0.50% interest rate cut. Jerome Powell said all members of the Federal Reserve agreed it

The Impact of Fed Rate Cuts on a $650,000 Mortgage: Short-Term and Long-Term Effects as the September 18, 2024 Federal Reserve meeting approaches, homeowners and

As the market moves toward more balance between buyers and sellers, parties on both sides of the transaction need to be prepared to negotiate. Insights

Should you buy a home now or should you wait? That’s a question a lot of people have these days. And while what’s right for

There is an increase in the number of listings coming to market lately, which suggests that many homeowners can no longer put off moving. More

If you haven’t already heard, homebuyers are regaining some negotiating power in today’s market. And while that doesn’t make this a buyer’s market, it does

Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what’s ahead. One thing

Photo by Tierra Mallorca on Unsplash At Mortgage Maestro Group, we understand that the home buying or refinancing process can be overwhelming. Many homeowners