The U.S. housing market is characterized by moderate inventory levels, with approximately 1.21 million existing single-family homes available. Despite rising inventory, affordability remains a significant challenge due to high mortgage rates and persistent home prices, leading to a slowdown in sales activity.

The U.S. housing market is characterized by moderate inventory levels, with approximately 1.21 million existing single-family homes available. Despite rising inventory, affordability remains a significant challenge due to high mortgage rates and persistent home prices, leading to a slowdown in sales activity.

Insights

“We expect the economy to land softly and housing inventory to continue to recover. This should put downward pressure on mortgage rates this fall and winter and will set the stage for a much better season for homebuyers in 2025.

Ralph McLaughlin, Senior Economist, Realtor.com

“Fed interest rate cuts in general will bring about lower [mortgage] rates, which is a definite boost to the housing market, but it won’t happen overnight.

Greg McBride, Chief Financial Analyst, Bankrate

Forecast

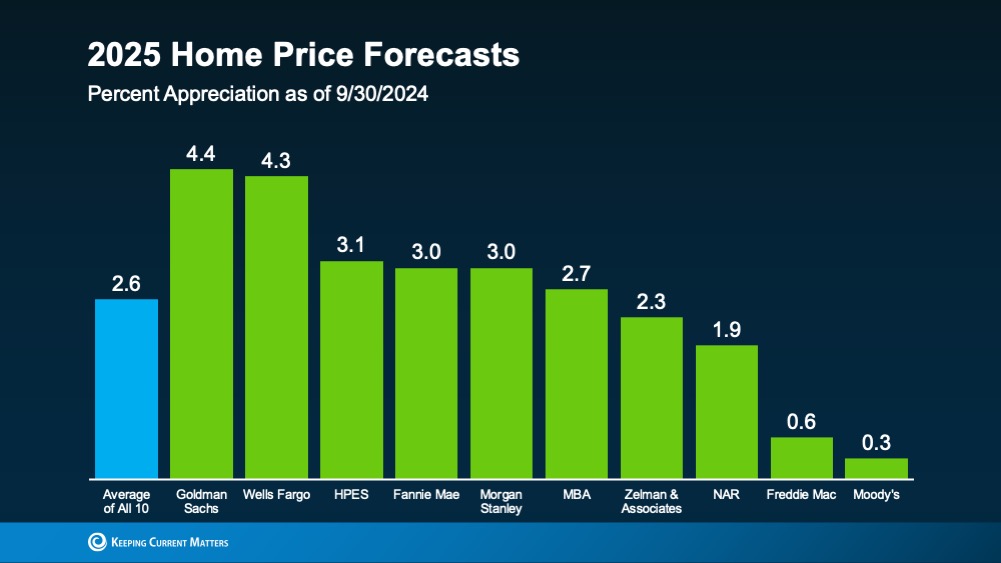

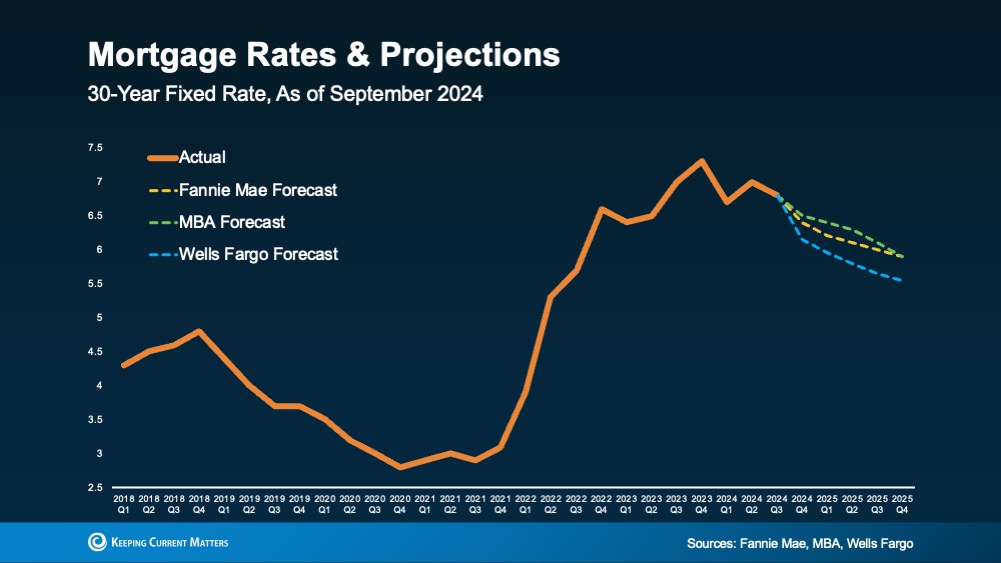

Looking ahead to 2025, predictions indicate a slow but steady decline in mortgage rates as inflation stabilizes and the Fed potentially loosens its aggressive rate-hiking stance. By mid-2025, rates are anticipated to average around 6.1%, with some potential to fall below 6%. Experts expect the U.S. housing market in 2025 to remain stable but somewhat restrained, with many forecasts indicate only modest increases in home prices, typically between 0.5% and 4% nationally.

Looking ahead to 2025, predictions indicate a slow but steady decline in mortgage rates as inflation stabilizes and the Fed potentially loosens its aggressive rate-hiking stance. By mid-2025, rates are anticipated to average around 6.1%, with some potential to fall below 6%. Experts expect the U.S. housing market in 2025 to remain stable but somewhat restrained, with many forecasts indicate only modest increases in home prices, typically between 0.5% and 4% nationally.

Rates

As of late October 2024, mortgage rates have seen fluctuations, primarily influenced by the strong U.S. economic outlook and inflationary pressures. Currently, the average rate for a 30-year fixed-rate mortgage stands between 6.54% and 7.07%, depending on the lender and credit qualifications. Experts predict that mortgage rates will likely end 2024 in a range between 6.5% and 6.8%, based on projections from several institutions.

As of late October 2024, mortgage rates have seen fluctuations, primarily influenced by the strong U.S. economic outlook and inflationary pressures. Currently, the average rate for a 30-year fixed-rate mortgage stands between 6.54% and 7.07%, depending on the lender and credit qualifications. Experts predict that mortgage rates will likely end 2024 in a range between 6.5% and 6.8%, based on projections from several institutions.

Affordability

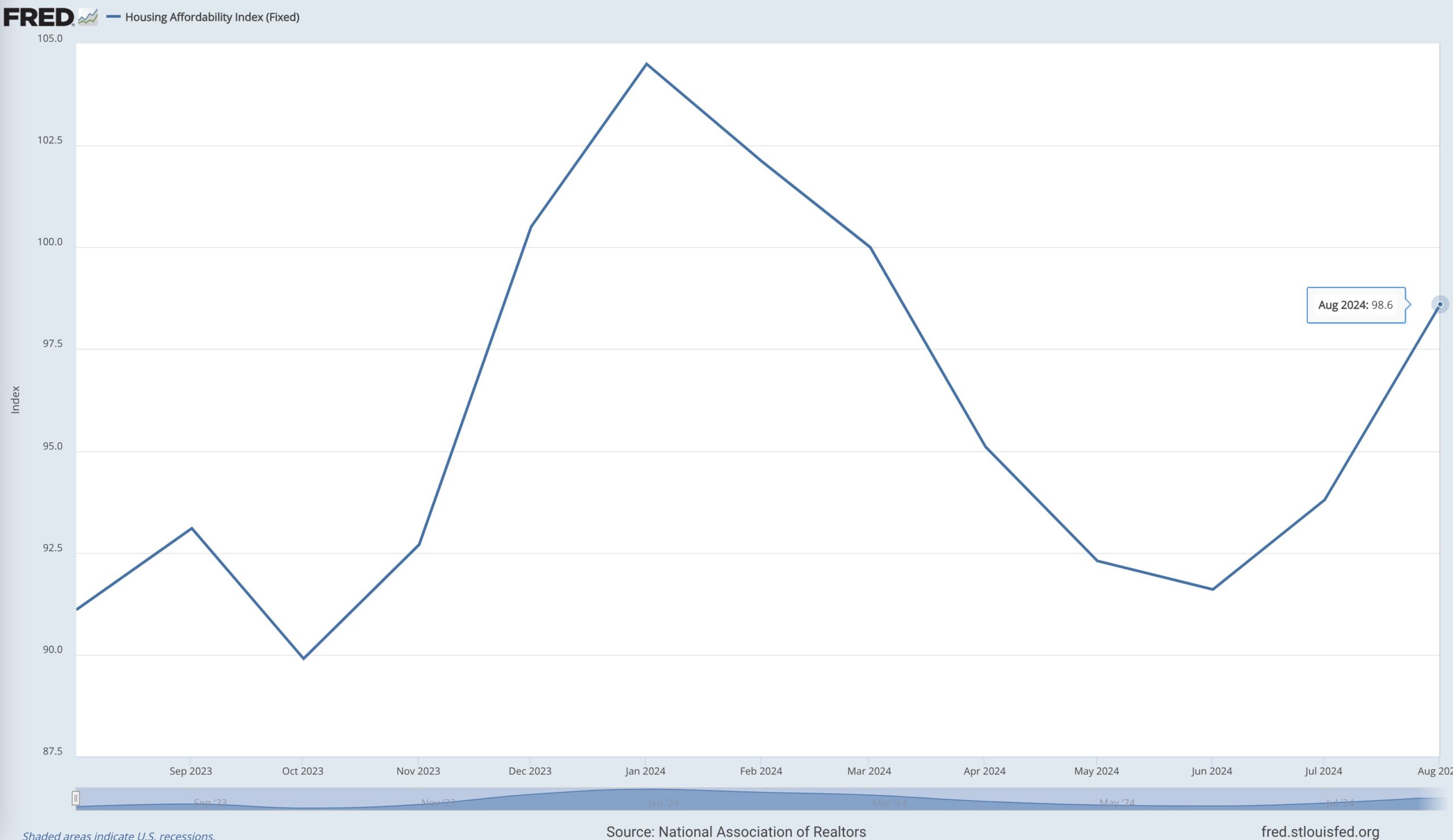

Housing affordability in the U.S. is currently at historic lows due to a combination of high mortgage rates, limited housing supply, and rising construction costs. According to the National Association of Home Builders, only about 38% of homes are affordable to families with the median U.S. income, marking one of the lowest levels of affordability since 2012.

Housing affordability in the U.S. is currently at historic lows due to a combination of high mortgage rates, limited housing supply, and rising construction costs. According to the National Association of Home Builders, only about 38% of homes are affordable to families with the median U.S. income, marking one of the lowest levels of affordability since 2012.

Inventory

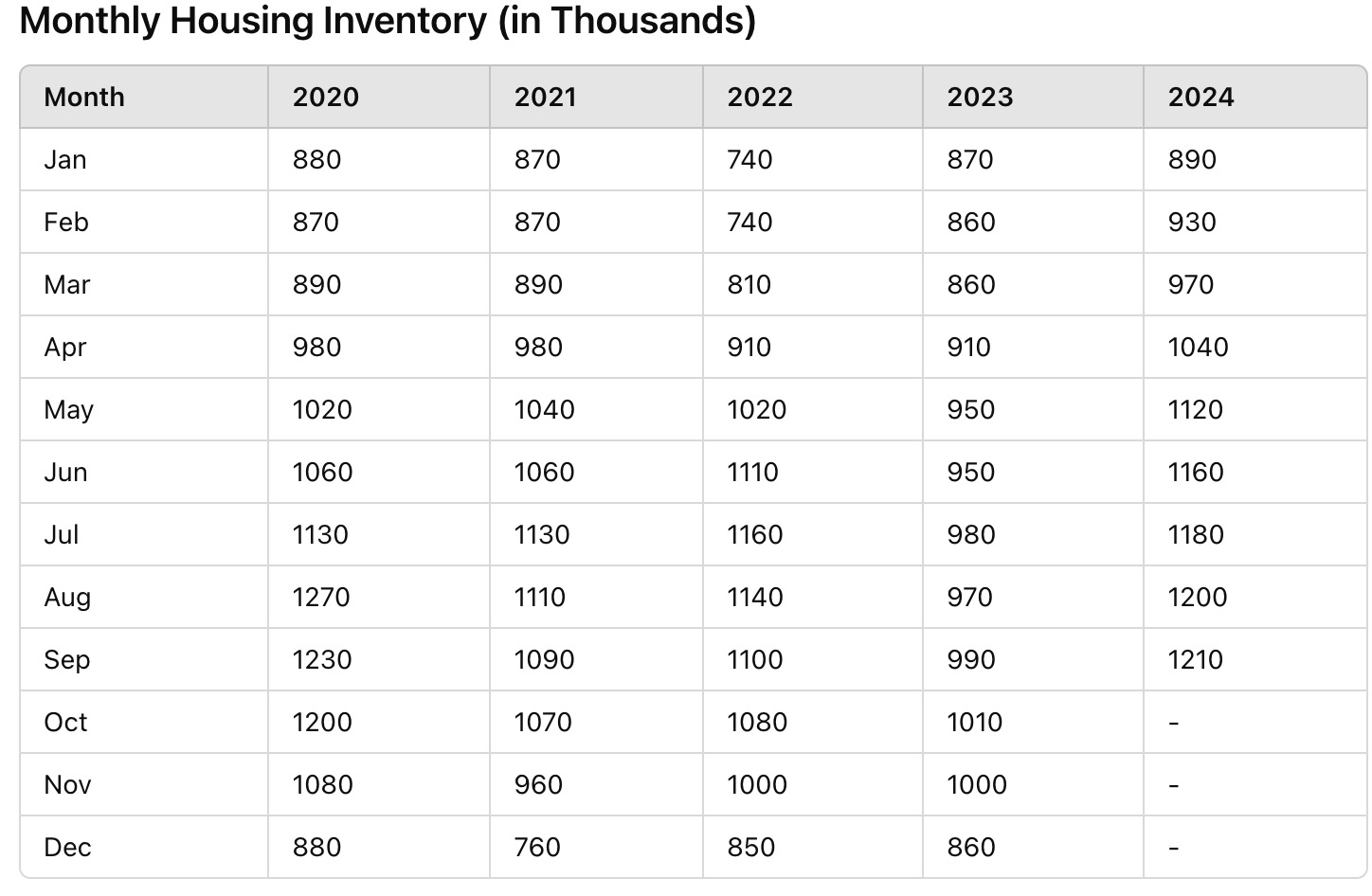

The National Association of Realtors reported that inventory for existing homes remains significantly below pre-pandemic levels, a trend exacerbated by current homeowners who are reluctant to sell and lose their historically low mortgage rates. As of the third quarter of 2024, inventory levels rose by over 30% compared to the previous year, but they are still about 26.7% lower than 2019 levels.

The National Association of Realtors reported that inventory for existing homes remains significantly below pre-pandemic levels, a trend exacerbated by current homeowners who are reluctant to sell and lose their historically low mortgage rates. As of the third quarter of 2024, inventory levels rose by over 30% compared to the previous year, but they are still about 26.7% lower than 2019 levels.

Sales

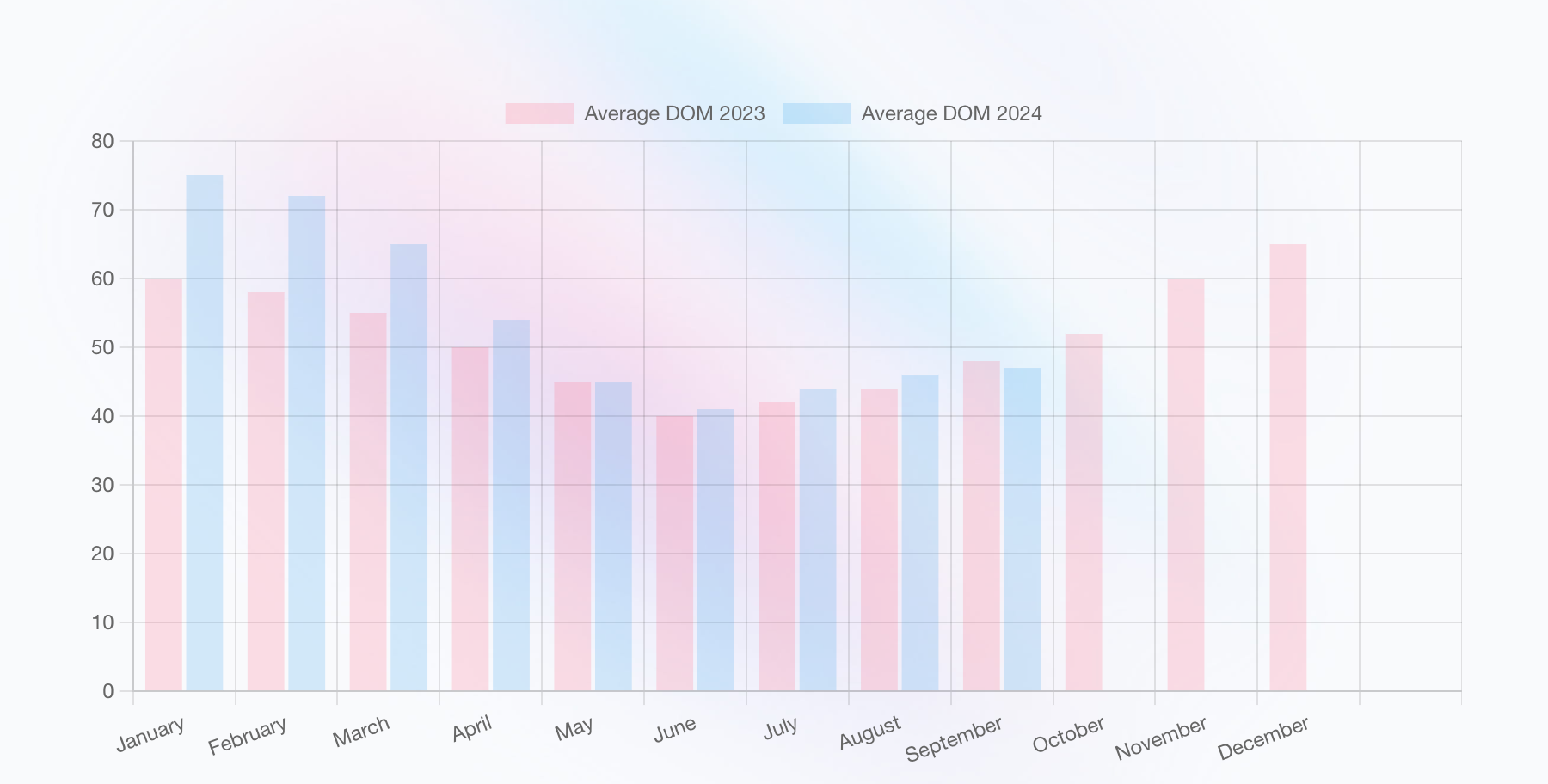

For each month of 2024 so far, the average days on market (DOM) for U.S. homes have generally reflected a cooling housing market, though it varies by region. Rising mortgage rates and broader economic uncertainties continue to affect housing demand, slowing sales in many areas.

For each month of 2024 so far, the average days on market (DOM) for U.S. homes have generally reflected a cooling housing market, though it varies by region. Rising mortgage rates and broader economic uncertainties continue to affect housing demand, slowing sales in many areas.

More Charts

Do you love housing data? Whether you are a real estate expert or just learning about the market, this is the data to know. Download the full report for 50+ charts illustrating the key metrics for the month.

Do you love housing data? Whether you are a real estate expert or just learning about the market, this is the data to know. Download the full report for 50+ charts illustrating the key metrics for the month.

Monthly Housing Market Report (PDF)

Mortgage Maestro Group – NMLS #1838215