The Impact of Fed Rate Cuts on a $650,000 Mortgage:

Short-Term and Long-Term Effects as the September 18, 2024 Federal Reserve meeting approaches, homeowners and prospective buyers are eagerly anticipating a potential fed rate cut. For those with a $650,000 mortgage or considering taking one out, understanding how Fed rate decisions influence mortgage rates is crucial. In this comprehensive guide, we’ll explore the potential short-term and long-term effects of a Fed rate cut on your mortgage, backed by historical data and expert analysis.

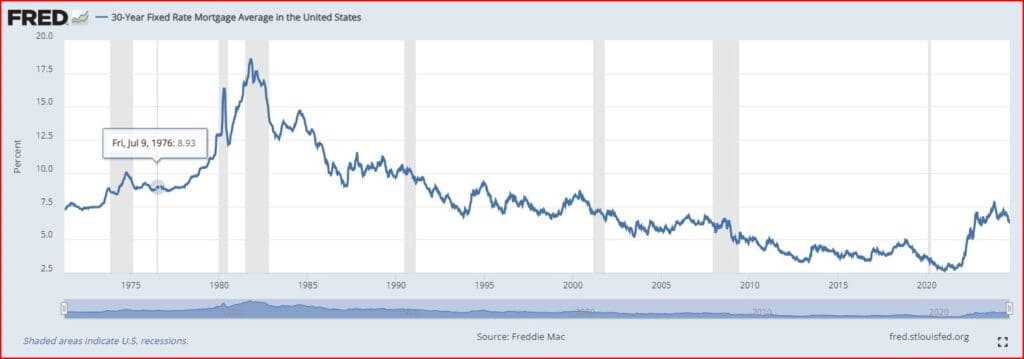

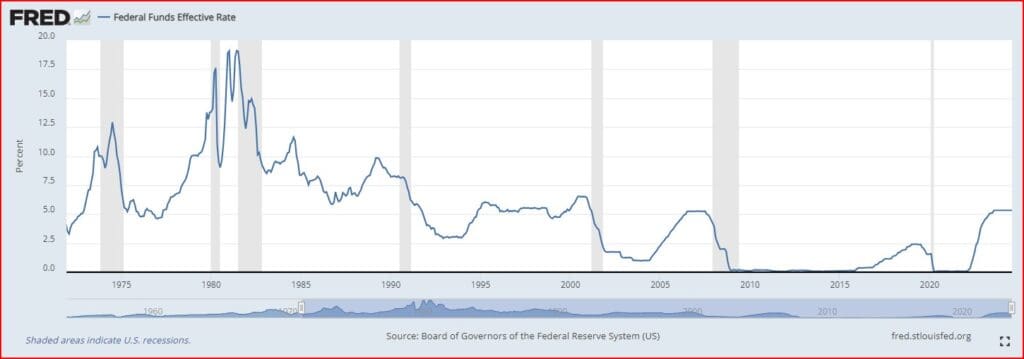

Understanding the Relationship Between Fed Rates and Mortgage Rates.

Before diving into the specifics, it’s important to clarify that the Federal Reserve does not directly set mortgage rates. Instead, the Fed’s decisions influence broader economic conditions, which in turn affect mortgage rates. The federal funds rate, which the Fed does control, has an indirect impact on mortgage rates, particularly adjustable-rate mortgages (ARMs). It is also believed by Janet Yellen that it is possible the Fed has achieved a soft landing.

Fixed-Rate vs. Adjustable-Rate Mortgages

- Fixed-rate mortgages: These are more closely tied to the 10-year Treasury yield than to the federal funds rate.

- Adjustable-rate mortgages: These are more directly influenced by Fed rate changes, as they often use indexes tied to short-term interest rates.

Short-Term Effects of a Fed Rate Cut on Your $650,000 Mortgage:

In the immediate aftermath of a Fed rate cut, you might expect to see some movement in mortgage rates. However, the impact is often not as direct or significant as many assume. Historical Short-Term Reactions to Fed Rate Cuts. Looking at past Fed rate cuts, we can observe some patterns:

- Immediate market reaction: Often, there’s a brief dip in mortgage rates following a Fed rate cut announcement.

- Limited impact on fixed rates: Fixed mortgage rates typically don’t move dramatically in the short term after a Fed cut. This year we have an election as well.

- More noticeable effect on ARMs: Adjustable-rate mortgages may see more immediate changes, especially if they’re due for an adjustment soon after the Fed cut.

Potential Short-Term Scenarios for a $650,000 Mortgage:

Let’s consider a few scenarios for a $650,000 mortgage immediately following a hypothetical 0.25% Fed rate cut:

- Fixed-rate mortgage:

- Current rate: 6.25%

- Monthly payment: $4,003

- Potential new rate: 6.15% (assuming a 0.10% decrease)

- New monthly payment: $3,957

- Monthly savings: $46

- 5/1 ARM in adjustment year:

- Current rate: 5.75%

- Monthly payment: $3,795

- Potential new rate: 5.50%

- New monthly payment: $3,691

- Monthly savings: $104

Long-Term Effects of Fed Rate Cuts on Mortgage Rates:

While short-term effects can be limited, the long-term impact of Fed rate cuts on mortgage rates is often more significant. This is because rate cuts typically signal a shift in monetary policy that can influence broader economic conditions over time. Historical Long-Term Trends Following Fed Rate Cuts. Analyzing past Fed rate cut cycles reveals some interesting trends:

- Gradual decline: Mortgage rates tend to decline gradually over several months following a series of Fed rate cuts.

- Lag time: There’s often a lag between Fed actions and significant mortgage rate movements, sometimes taking 3-6 months to fully materialize.

- Market expectations: Long-term mortgage rates often start moving before the Fed actually cuts rates, as markets anticipate future policy changes.

Case Study: 2001 Fed Rate Cut Cycle:

In 2001, the Fed cut rates 11 times, lowering the federal funds rate from 6.5% to 1.75%. Here’s how 30-year fixed mortgage rates responded:

- January 2001 (before cuts began): 7.03%

- December 2001 (after 11 cuts): 7.07%

- June 2002 (6 months later): 6.65%

- December 2002 (1 year later): 6.05%

This example illustrates how mortgage rates can take time to fully reflect Fed policy changes.

Potential Long-Term Scenarios for a $650,000 Mortgage:

Considering historical trends, let’s project potential long-term scenarios for a $650,000 mortgage following a series of Fed rate cuts:

- Moderate decline scenario:

- Starting rate: 6.25%

- Monthly payment: $4,003

- Rate after 6 months: 5.75%

- New monthly payment: $3,795

- Monthly savings: $208

- Significant decline scenario:

- Starting rate: 6.25%

- Monthly payment: $4,003

- Rate after 12 months: 5.25%

- New monthly payment: $3,591

- Monthly savings: $412

Factors Influencing Mortgage Rate Changes Beyond Fed Decisions:

While Fed rate cuts play a role in shaping mortgage rates, several other factors contribute to rate movements:

- Inflation expectations

- Economic growth projections

- Global economic conditions

- Investor demand for mortgage-backed securities

- Housing market trends

These factors can sometimes counteract the effects of Fed rate cuts, leading to unexpected mortgage rate movements.

Strategies for Homeowners and Buyers in a Falling Rate Environment:

If you have a $650,000 mortgage or are considering one, here are some strategies to consider as rates potentially decline:

- Refinancing: Monitor rates closely and consider refinancing if you can save at least 0.75% on your current rate.

- ARM vs. fixed-rate: Evaluate whether an ARM might be beneficial in a falling rate environment.

- Points: Consider paying points to lower your rate further if you plan to stay in the home long-term.

- Timing: Don’t try to time the market perfectly; if rates are favorable and align with your financial goals, act decisively.

Expert Opinions on the Future of Mortgage Rates;

Preparing for Potential Rate Changes. While a Fed rate cut can signal the beginning of a lower-rate environment for mortgages, the relationship is complex and influenced by numerous factors. For homeowners with a $650,000 mortgage or those considering taking one out, it’s crucial to:

- Stay informed about economic trends and Fed policies

- Regularly review your mortgage terms and compare them to current market rates

- Consult with financial advisors or mortgage professionals to make informed decisions

- Consider your long-term housing plans when making mortgage decisions

By understanding the nuanced relationship between Fed actions and mortgage rates, you’ll be better equipped to navigate the changing landscape and make financial decisions that align with your goals. Schedule a call to understand how this affects you.

Mortgage Maestro Group – NMLS #1838215