The financial landscape has shifted dramatically with the Federal Reserve’s 0.50% interest rate cut. Jerome Powell said all members of the Federal Reserve agreed it was time to take action. For homeowners and property investors this presents a unique opportunity to optimize financial strategies and potentially save thousands of dollars. Let’s dive into what this rate cut means for you and how to capitalize on it.

Why the Interest Rate Cut Happened

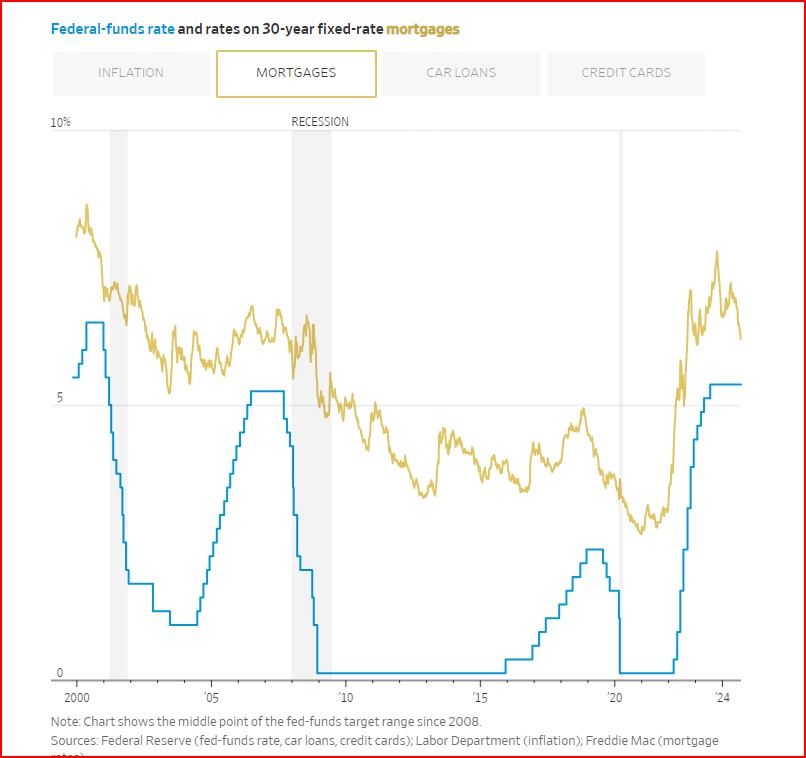

Economic policymakers adjust interest rates to stimulate growth or manage inflation. This iteration, the first since 2020, is in reaction to inflation coming down. Powell’s focus is on sustaining strength in the labor market, and promoting economic growth. Unemployment has risen since mid-2023, so the Fed is hoping to prevent further weakening in the job market. This recent cut aims to:

- Boost Economic Activity: Lower borrowing costs encourage spending and investment across sectors.

- Support the Housing Market: More affordable mortgages can increase home purchases and refinancing activity.

- Counter Economic Slowdown: Acts as a preemptive measure against potential economic downturns, ensuring stability.

Immediate Effects on Mortgages:

Lower Monthly Payments

The rate cut has significant implications for mortgage holders:

- New Mortgages: Expect lower interest rates, eventually, potentially reducing monthly payments by hundreds of dollars.

- H.E.L.O.Cs (Home Equity Line of Credit): Rates will downward, decreasing existing payments and offering immediate savings. As example if you owe $200,000, the .50% decrease will reduce your annual payment by $1,000.

Lower Returns on Your Savings Accounts

You may be surprised to know that the money in that H.Y.S.A (High Yield Savings Account) is pegged to what just happened today. So expect to see on an upcoming statement that the bit of interest you are receiving just went down. Consult with your financial advisor to see if you should reallocate some of that savings into the financial markets as a result of today’s interest rate cut.

Increased Borrowing Power

Lower rates translate to enhanced financial flexibility:

- Higher Loan Amounts: Qualified buyers may now be eligible for larger mortgages, expanding housing options.

- Better Terms: More favorable loan conditions could be available, including lower fees and more flexible repayment options.

Opportunities for Refinancing

Now is an excellent time to consider refinancing your mortgage:

- Reduce Interest Costs: Lock in a lower rate to potentially save tens of thousands over the life of your loan.

- Change Loan Terms: Adjust the length of your mortgage to align with your financial goals, whether that’s paying off your home faster or reducing monthly payments.

- Consolidate Debt: Combine higher-interest debts into a lower-rate mortgage, simplifying finances and reducing overall interest payments.

Impact on Property Investments

Increased Demand

The rate cut is likely to heat up the real estate market:

- Buyer’s Market Shift: More people can afford homes, potentially increasing competition for desirable properties.

- Property Values: Higher demand may drive up prices, benefiting current homeowners and investors.

Investment Strategies

Consider these approaches to maximize the benefits of the rate cut:

- Buy and Hold: Acquire properties now to benefit from potential appreciation as demand increases.

- Rental Opportunities: Lower mortgage costs can improve rental yield, making investment properties more profitable.

FAQs About the Interest Rate Cut

Q: How soon will mortgage rates reflect the interest rate cut?

A: Mortgage rates typically adjust within weeks to months of a Fed rate cut. It’s best to consult with a lender to get current rates and lock in favorable terms quickly.

Q: Is now a good time to buy a home?

A: With lower interest rates, your purchasing power increases, making it an opportune time to buy. However, consider your personal financial situation and long-term goals before making a decision. Lower rates often lead to higher asset prices.

Q: Should I switch from a variable-rate to a fixed-rate mortgage?

A: If you anticipate rates rising in the future, locking in a fixed rate now could be beneficial. Analyze your risk tolerance and long-term housing plans to make the best choice.

Q: How does the rate cut affect home equity lines of credit (HELOCs)?

A: HELOC rates, which are often variable, should decrease, reducing your interest payments and potentially freeing up cash for other investments or debt reduction. Check with your HELOC servicer, or on your next statement to see if the rate did go down.

Your Next Steps

To take full advantage of the current low-interest environment:

- Review Your Mortgage: Analyze your current terms and see if refinancing could lead to significant savings.

- Explore Investment Opportunities: Consider expanding your property portfolio while financing costs are low.

- Consult with Experts: Speak to a financial advisor or mortgage broker to tailor a strategy to your unique situation.

Ready to Maximize Your Homeownership Benefits?

Don’t let this opportunity pass you by. The financial landscape has changed, and acting now could set you up for long-term financial success. Contact Mortgage Maestro Group today to navigate the new financial landscape and make the most of the interest rate cut. Whether you are in Denver, Dallas, anywhere in Colorado or Texas our team of experts is ready to help you optimize your mortgage strategy and build wealth through real estate. You can also schedule a complimentary no obligation consultation here as well.

Mortgage Maestro Group – NMLS #1838215