Saving for a Down Payment? Here’s What You Need To Know

If you’re planning to buy your first home, then you’re probably focused on saving for all the costs involved in such a big purchase. One

If you’re planning to buy your first home, then you’re probably focused on saving for all the costs involved in such a big purchase. One

If you’re thinking about buying or selling a house, it’s important to know that it doesn’t just affect your life, but also your community. The

Buying your first home is an exciting decision and a major milestone that has the power to change your life for the better. As a first-time homebuyer,

The process of buying a home can feel a bit intimidating, even under normal circumstances. But today’s market is still anything but normal. There continues

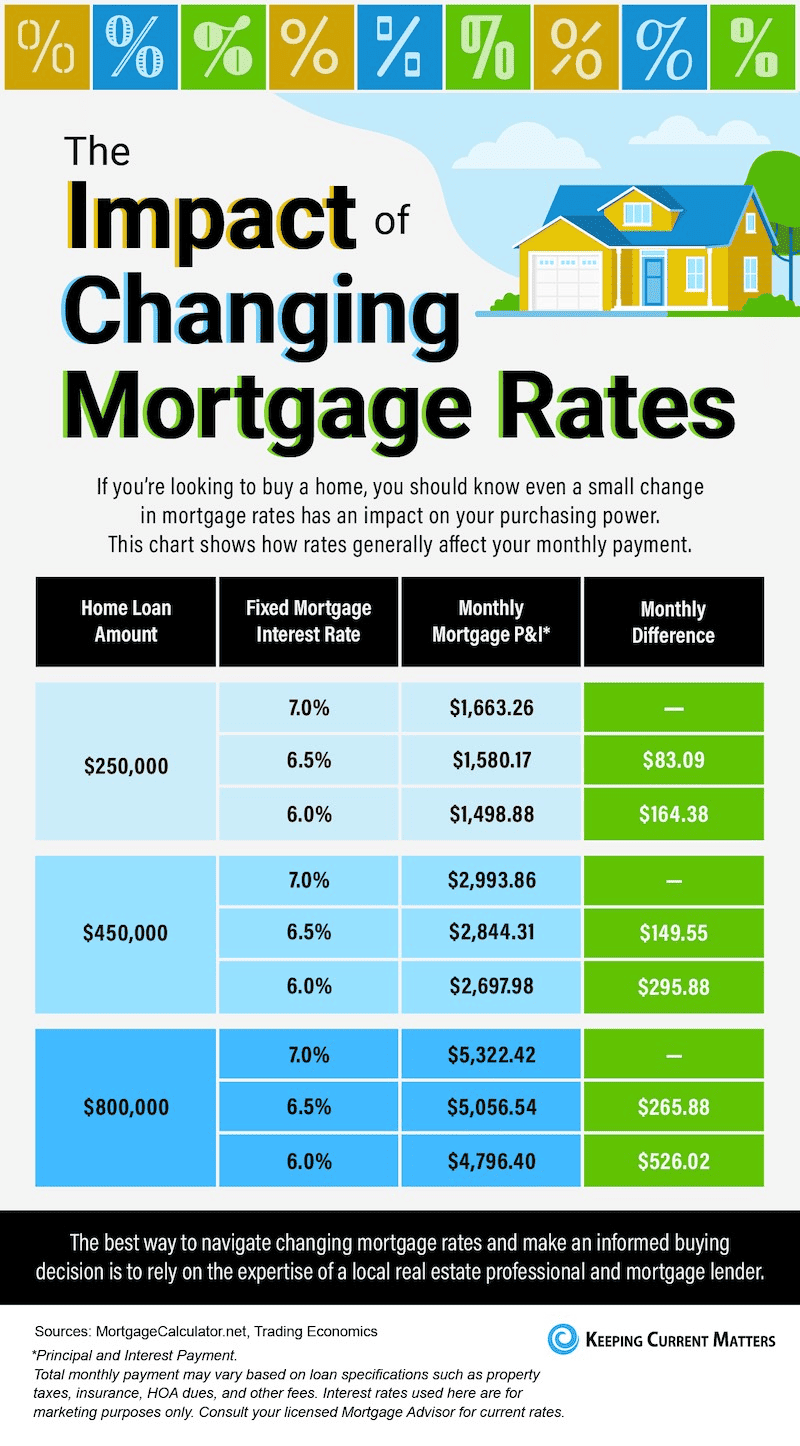

Today, we’ll explore the factors that affect mortgage rates and how they can impact your real estate endeavors. To kick things off, let’s delve into

If you’re buying a home this spring, today’s housing market can feel like a challenge. With so few homes on the market right now, plus higher

If you’re looking to buy a house, you may find today’s limited supply of homes available for sale challenging. When housing inventory is as low

There’s been a lot of focus on higher mortgage rates and how they’re creating affordability challenges for today’s homebuyers. It’s true that rates climbed dramatically

If you’re thinking about selling this spring, it’s time to get moving – the best week to list your house is fast approaching. Experts at

If you’re thinking about buying a home, you want to know the decision will be a good one. And for many, that means thinking about

Even though activity in the housing market has slowed from the frenzy we saw over a year ago, today’s low supply of homes for sale

Over the past year, home prices have been a widely debated topic. Some have said we’ll see a massive drop in prices and that this