You are in the early stages of buying a new home. You have decided a new home is what you want, and you have both a mortgage broker and real estate agent in mind. Your biggest question right now is how much house you can afford. You would like to have some baseline figures before you even start looking. Enter the mortgage calculator.

As a Colorado mortgage broker, we have a mortgage calculator available here on our website. Mortgage calculators are helpful tools that give buyers a starting point in understanding some of the financial basics of buying a home. Used in conjunction with sound advice from a mortgage broker and real estate agent, a mortgage calculator can help by being a financial guidepost as you search for homes that appeal to you.

What a Mortgage Calculator Does

Taking on a home mortgage is arguably the biggest financial responsibility anyone will assume. These days, buying a house means spending hundreds of thousands of dollars. That is a lot of debt to have hanging over your head. Moreover, not taking on more than one can reasonably handle is a legitimate concern. A mortgage calculator is a tool capable of providing clarity within the home buyer’s budget.

In the simplest possible terms, a mortgage calculator is a tool through which you can estimate the monthly payments you would make on a particular home loan after considering the most common factors in the equation. A typical mortgage calculator needs the following information at minimum:

- Loan Amount – This is the total amount you are hoping to borrow.

- Down Payment – This is the amount of money you bring to the table as cash.

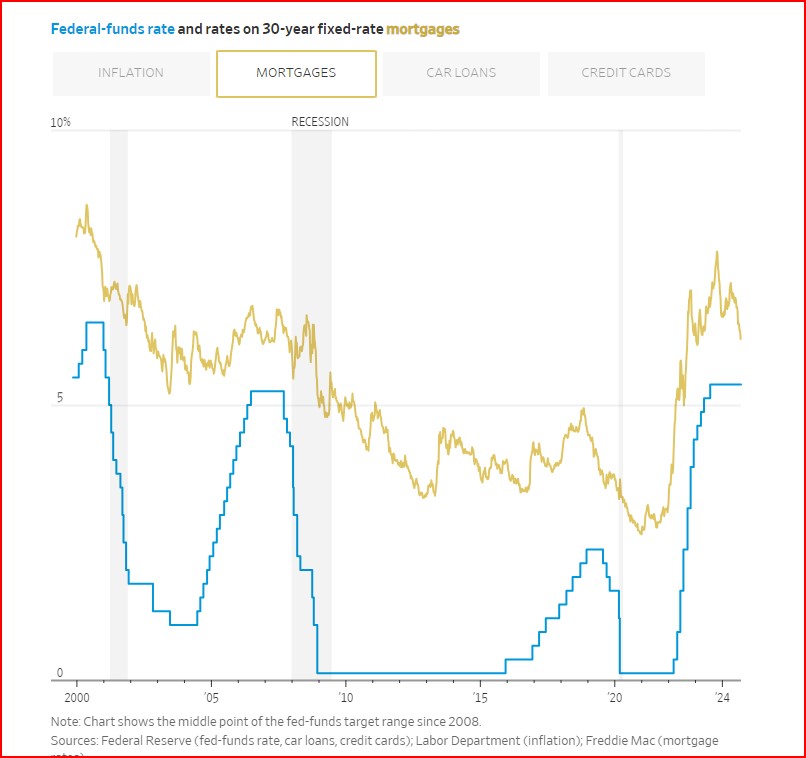

- APR – Mortgage calculators need the annual percentage rate rather than just the interest rate.

- Loan Term – This is the length of the loan (e.g., 15, 20, or 30 years).

Mortgage calculators might request additional information as well. For example:

- Property Tax Rates – Local governments assess property taxes on residential properties. They are easy enough to find if you know where to look.

- Homeowners’ Insurance – An estimate on homeowners’ insurance will help the calculator return more accurate numbers.

- Private Mortgage Insurance (PMI) – PMI is required when buyers put down less than 20%. It can be canceled once a homeowner has 20% equity.

After entering all the relevant information, you click a button and let the calculator do its thing. It returns an estimate of your monthly payments based on the information provided. But understand that the numbers are not guaranteed. Estimates are what they are. Your actual numbers at closing are most likely going to be different.

Use It as a Guide

Mortgage brokers and bankers alike encourage home buyers to use a mortgage calculator only as a guide. A calculator can guide you toward a better understanding of what you can reasonably afford. How does that help? If you commit to looking only at houses that fit within those numbers, you run less of a risk of overcommitting to too much house with too high a mortgage payment.

It is also important to note that there may be other factors your mortgage calculator doesn’t account for. A good example is a monthly or annual homeowner’s association (HOA) fee. HOA fees add to the total cost of owning a home. They can be pretty significant.

When all is said and done, be sure to get and heed the advice of a licensed mortgage broker or other mortgage professional. That advice is designed to help you make a wise decision you are not likely to regret.

We have a smart mortgage calculator available on our site that can help you plan and understand your buying potential. Contact us today to discuss your loan options or apply now on our site.