Colorado, a state in the western United States, joined the Union on August 1, 1876, becoming the 38th state. It has a population of over 5 million as of 2020, making it the twenty-first most populated state in the country.

Living in Colorado First-Time Homebuyer, you may qualify for various state and local financing programs, even with less-than-perfect credit or limited financial reserves. These programs can assist with down payments and closing costs.

Additionally, you may combine these benefits with loans backed by the Federal Housing Administration (FHA). If you’re unable to afford a traditional 20% down payment, consider reaching out to the Department of Agriculture (USDA) or the Department of Veterans Affairs (VA).

How and Why should I Buy a House in Colorado

The process of buying a home in Colorado mirrors that of any other state, If you are considering relocating or already residing here. This blog will educate you the right mortgage and ensuring you don’t overlook valuable assistance programs:

1. Consider Market Climate

Understanding market conditions is important when making decisions about buying or selling a home. Consider if home prices are steadily increasing or fluctuating. Will it affect your plans if you decide to sell in a few years? Being aware of these factors can improve your chances of building equity in your home during the initial years of ownership.

Recent statistics reveal the demand in the Colorado housing market. In February 2024, 23.8% of homes in Colorado were sold above the list price, a 0.3-point increase from the previous year.

Conversely, only 24.1% of homes experienced price drops, up from 23.0% the previous year. The sale-to-list price ratio stands at 98.7%, marking a 0.1-point increase from the previous year.

Home sales data from January 2023 indicates a 0.9% year-over-year decrease in home sales. In January 2024, only 3,798 homes were sold, down from 3,833 in January 2023.

While researching may seem overwhelming, real estate agents are valuable in navigating the market. For those willing to put in the effort, platforms like Zillow offer local market reports to help understand pricing trends.

2. Job Opportunities

According to the U.S. Bureau of Labor Statistics, Colorado had 207,000 job openings in December 2023, compared to 224,000 openings in November. This trend is constantly increasing due to the establishment and growth of businesses.

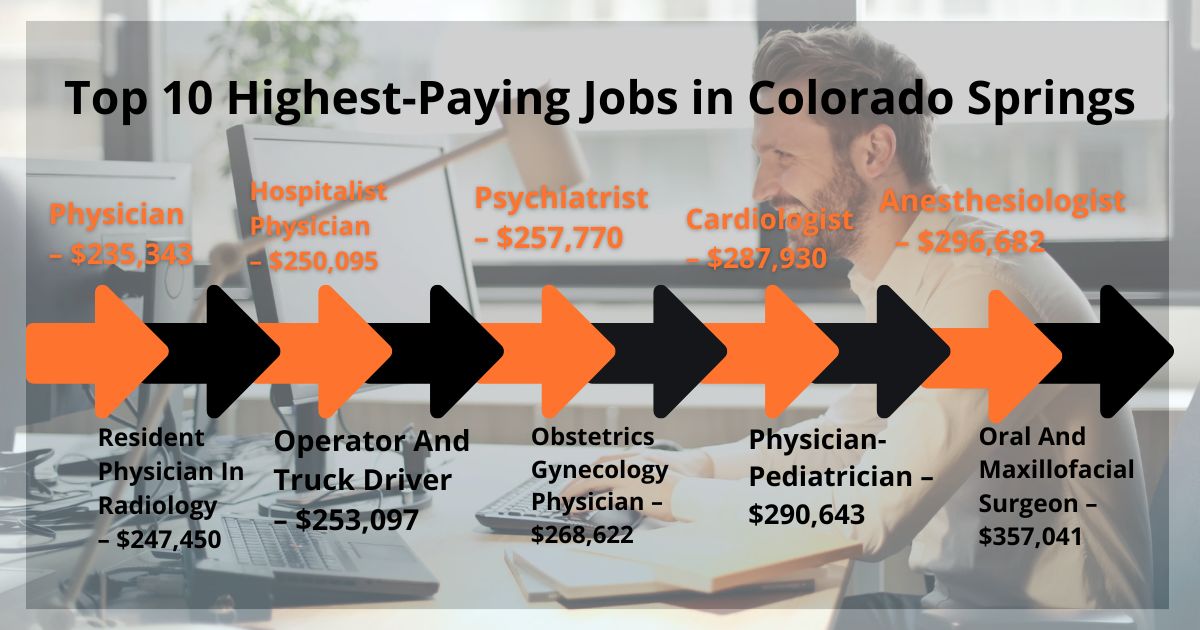

The highest-paying jobs in Colorado Springs span various industries, including healthcare, technology, and finance. This list, sourced from the Bureau of Labor Statistics, highlights the top 25 highest-paying professions in 2024. While many roles require significant experience, there are lucrative entry-level positions for qualified candidates.

Here’s a glimpse at the top 10 highest-paying jobs in Colorado Springs:

- Oral And Maxillofacial Surgeon – $357,041

- Anesthesiologist, Pain Management Specialist – $296,682

- Physician-Pediatrician – $290,643

- Cardiologist – $287,930

- Obstetrics Gynecology Physician – $268,622

- Psychiatrist – $257,770

- Operator And Truck Driver – $253,097

- Hospitalist Physician – $250,095

- Resident Physician In Radiology – $247,450

- Physician – $235,343

Additionally, With remote work becoming more common, you have the flexibility to choose where you live based on your preferences rather than proximity to your workplace. This shift has opened up new possibilities, allowing people to live where they truly want.

3. Explore Assistance Programs

Colorado offers various statewide and local programs and grants, along with federal financing options like FHA, VA, USDA and Conventional loans, that you could utilize to attain your dream home. These programs are particularly beneficial for first-time homebuyers or individuals with lower incomes or credit scores.

Below is a concise overview of four common types of mortgages: FHA, VA, USDA, and Conventional. This comparison will help you determine which mortgage type best suits your needs and financial situation.

| Mortgage Type | Minimum Down Payment | Minimum Credit Score | Best For |

| FHA Mortgages | 3.5% | 500 to 580 | First-time homebuyers, low-credit score buyers |

| VA Loans | Zero | None | Veterans, military members, spouses |

| USDA Loans | Zero | Typically 640 | Rural homebuyers, low-income buyers |

| Conventional | 3% | Typically 620 | Buyers with good credit |

4. Find a Compatible Lender

Not finding a compatible lender could lead to missed opportunities and financial setbacks for potential homebuyers. Here’s why:

Missing out on assistance programs that offer better mortgage terms.

Risk of ending up with a lender who doesn’t provide the most favorable terms, resulting in higher costs over time.

Importance of taking time to find the right lender for a smooth and financially beneficial homebuying process.

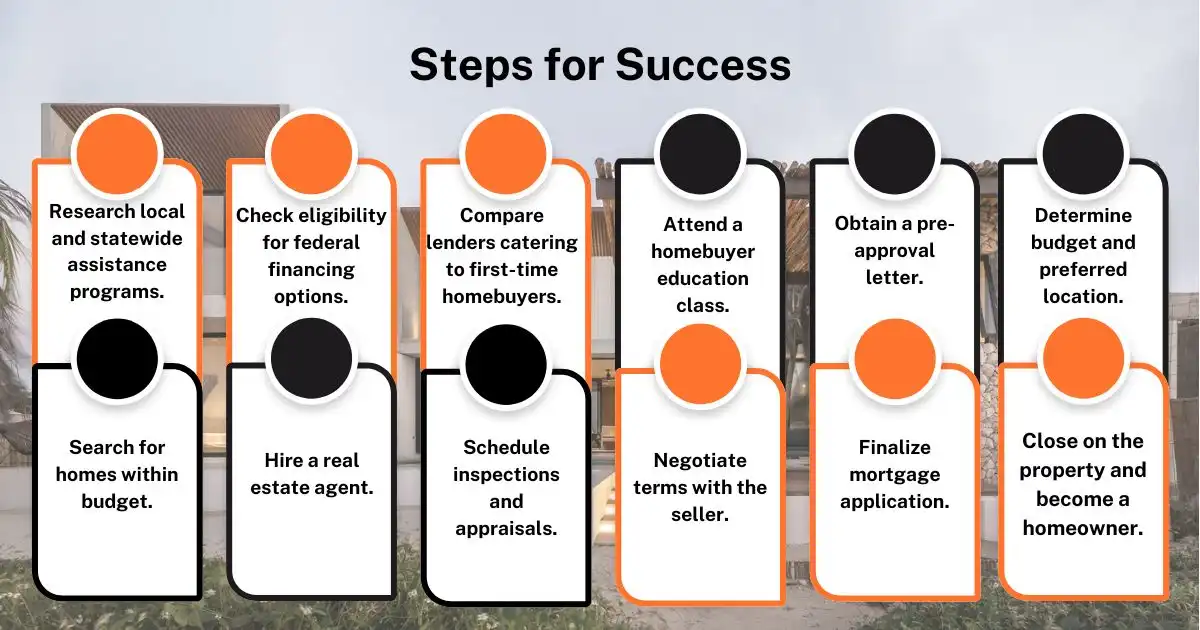

To ensure success, follow these steps:

- Research local and statewide assistance programs.

- Check eligibility for federal financing options.

- Compare lenders catering to first-time homebuyers.

- Attend a homebuyer education class.

- Obtain a pre-approval letter.

- Determine budget and preferred location.

- Search for homes within budget.

- Hire a real estate agent.

- Schedule inspections and appraisals.

- Negotiate terms with the seller.

- Finalize mortgage application.

- Close on the property and become a homeowner.

If you’re struggling with the process or need to find a suitable lender, Mortgage Maestro Group can assist you. Whether you’re refinancing, a first-time buyer, purchasing a rental property, or ready for your dream home, we’ve got you covered.

5. Apply for Assistance

Once you’ve found a home and entered into a contract, you can begin the application process for first-time homebuyer assistance. This typically takes around three weeks to complete, with guidance from your lender.

The Colorado Housing and Finance Authority (CHFA) offers mortgage loans with flexible financing options, allowing borrowers to secure up to 100% of the loan amount with down payments as low as 3%. These loans feature fixed interest rates and 30-year repayment terms.

Additionally, CHFA provides a secondary mortgage loan to assist with down payments and closing costs. Borrowers can receive loan proceeds of up to 4% of their first mortgage’s value, with the option to defer repayment until they’ve paid off their primary loan, refinanced it, or sold their property.

It’s important to note that borrowers must contribute a minimum of $1,000 towards the loan and meet specified income, credit, and lender underwriting criteria to qualify for certain products.

Minimum borrower requirements include:

- A minimum credit score of 620

- Attending an approved homebuyer education before closing (in-person or online)

- Not exceeding CHFA income limits on total borrower income

6. Attending Homebuyer Education Classes

It’s wise to attend a first-time homebuyer education class before closing on your home. These classes, available in-person or online, offer valuable insights and may be required by some assistance programs.

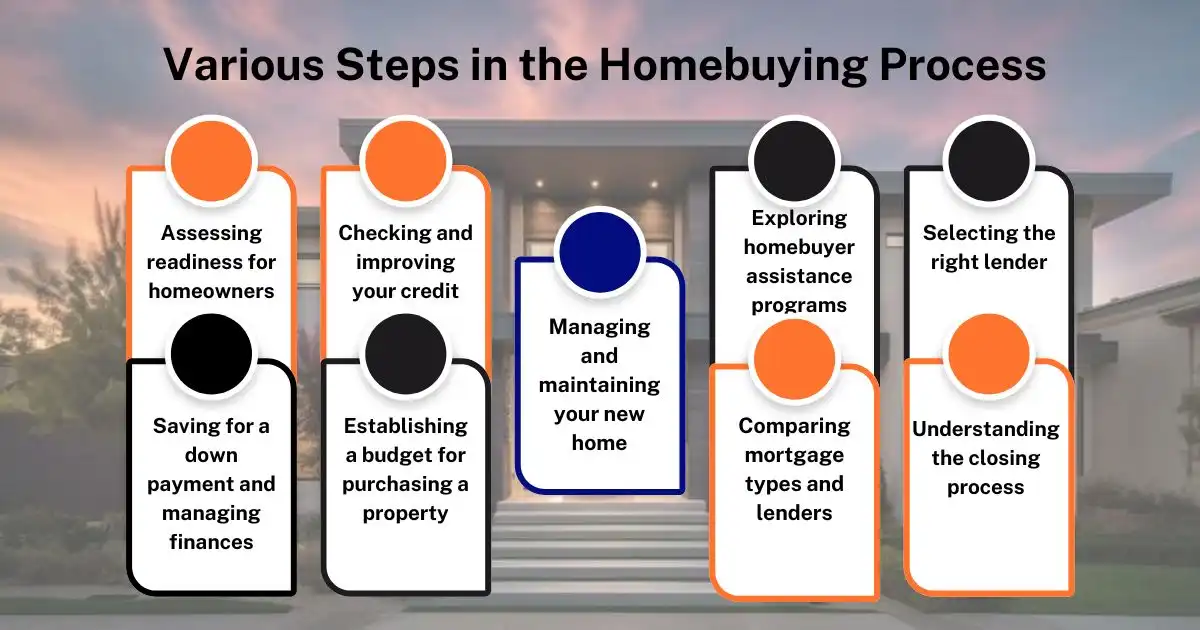

These classes aim to help you understand the entire process of buying and owning a home to ensure you’re ready for the commitment. You’ll learn about various steps in the homebuying process, including:

- Assessing readiness for homeownership

- Saving for a down payment and managing finances

- Checking and improving your credit score

- Establishing a budget for purchasing a property

- Exploring homebuyer assistance programs

- Comparing mortgage types and lenders

- Selecting the right lender

- Understanding the closing process

- Managing and maintaining your new home

Homebuyer education classes vary depending on the organization offering them and the topics covered. There’s also a difference between attending in person and taking an online class.

7. Close the Deal

Upon approval, you’ll finalize your loan terms and complete the homebuying process by signing closing documents. However, it’s not as easy as that. Colorado home buyers typically spend an average of $3,881 on closing costs. These are expenses you need to pay out of pocket for financing, buying, and owning a home.

Closing costs vary depending on the location and can amount to several thousand dollars in some areas of Colorado. This significant amount may come as a surprise to first-time home buyers who are busy saving up for the down payment.

As a general guideline, it’s recommended to set aside 2% to 5% of the purchase price to cover closing costs in Colorado. Here’s a breakdown of the most common estimated closing costs for buyers in Colorado:

| Expense | Estimated Cost |

| Loan Application Fee | $150 to $500 |

| Loan Origination Fee | 0.5% to 1.5% of the mortgage value |

| Home Appraisal Fee | $300 to $700 |

| Credit Report Fee | $75 to $150 |

| Title Commitment & Closing | $600-$900 |

| Title Owners Title Policy | $500 to $1500 |

| Recording Fees | $1.00 to $1.75 per thousand |

| Discount Points | +/-1% of the mortgage value (*Should you choose to buy down the rate) |

| Escrow Account Setup Funds | At least 2 months of total of escrow payments |

| Transfer Tax | 0.02% of the purchase price (*Where applicable) |

| Home Inspection Fee (Outside the loan) | $300 to $600 |

| Home Owners Insurance | $2,500-$4,500 per year |

| Recording Fee | $150 to $200 |

Come on over to Colorado First-Time Homebuyer with Mortgage Maestro Group

Why stress over the transaction process when we can handle it for you? Enjoy the perks of expert guidance, personalized assistance, and a hassle-free journey to your new home.

Forget about dealing with the process yourself and just focus on imagining yourself in your dream home. Let’s make it happen together! Reach out to us today to get started.

Final Thoughts

Without professional help, going through the homebuying process in Colorado could mean missing out on valuable assistance programs and making costly mistakes. However, with support from experts like Mortgage Maestro Group, first-time buyers can access resources and expertise to make the process smoother and secure their dream home confidently.

Homeownership in Colorado offers stability, equity building, and a fulfilling lifestyle, especially with diverse job opportunities and vibrant communities. With a supportive team, buyers can manage the market complexities, capitalize on assistance programs, and pursue homeownership with peace of mind.

Key Takeaways:

- Professional Help: Working with professionals like Mortgage Maestro Group provides access to essential resources and guidance, minimizing the chances of mistakes and financial difficulties during the homebuying journey.

- Benefits of Colorado: Owning a home in Colorado brings stability and the chance to build equity, along with diverse job prospects and a lively community atmosphere.

- DIY Risks: Attempting to navigate the process alone could mean overlooking valuable support programs and making costly errors, leading to elevated expenses and added pressure.

FAQs

Is it a good idea to buy a house in Colorado?

As Colorado First-Time Homebuyer, buying a house in Colorado can be a great idea due to its stable real estate market, potential for equity growth, and diverse lifestyle offerings. However, it’s essential to consider factors like location, market conditions, and personal financial readiness before making a decision.

Does Colorado have a first-time homebuyer program?

Yes, Colorado First-Time Homebuyer programs aimed at helping individuals achieve homeownership more easily. These programs often provide assistance with down payments, closing costs, and low-interest loans to eligible applicants.

What should you consider when buying your first home?

When buying your first home, consider factors such as your budget, desired location, property type, mortgage options, and potential for future resale value. Additionally, factor in ongoing expenses like property taxes, insurance, and maintenance costs.

How much money do I need to buy a house in Colorado?

As Colorado First-Time Homebuyer, the amount of money needed to buy a house in Colorado varies depending on factors like the home’s price, down payment percentage, closing costs, and financing options. Typically, buyers should aim to have enough savings for a down payment (usually around 3-20% of the home’s purchase price), closing costs (approximately 2-5% of the home’s price), and additional expenses like inspections and moving costs.

Mortgage Maestro Group – NMLS #1838215