Keys to Success for First-Time Homebuyers

Buying your first home is an exciting decision and a major milestone that has the power to change your life for the better. As a first-time homebuyer,

Buying your first home is an exciting decision and a major milestone that has the power to change your life for the better. As a first-time homebuyer,

The process of buying a home can feel a bit intimidating, even under normal circumstances. But today’s market is still anything but normal. There continues

Today, we’ll explore the factors that affect mortgage rates and how they can impact your real estate endeavors. To kick things off, let’s delve into

If you’re buying a home this spring, today’s housing market can feel like a challenge. With so few homes on the market right now, plus higher

Buying a home is an exciting and significant milestone in life. It’s a journey filled with dreams, aspirations, and new beginnings. As you embark on

If you’re looking to buy a house, you may find today’s limited supply of homes available for sale challenging. When housing inventory is as low

Our monthly real estate market report includes information about housing prices, inventory, mortgage rates, home sales and market predictions. We summarize news headlines and share

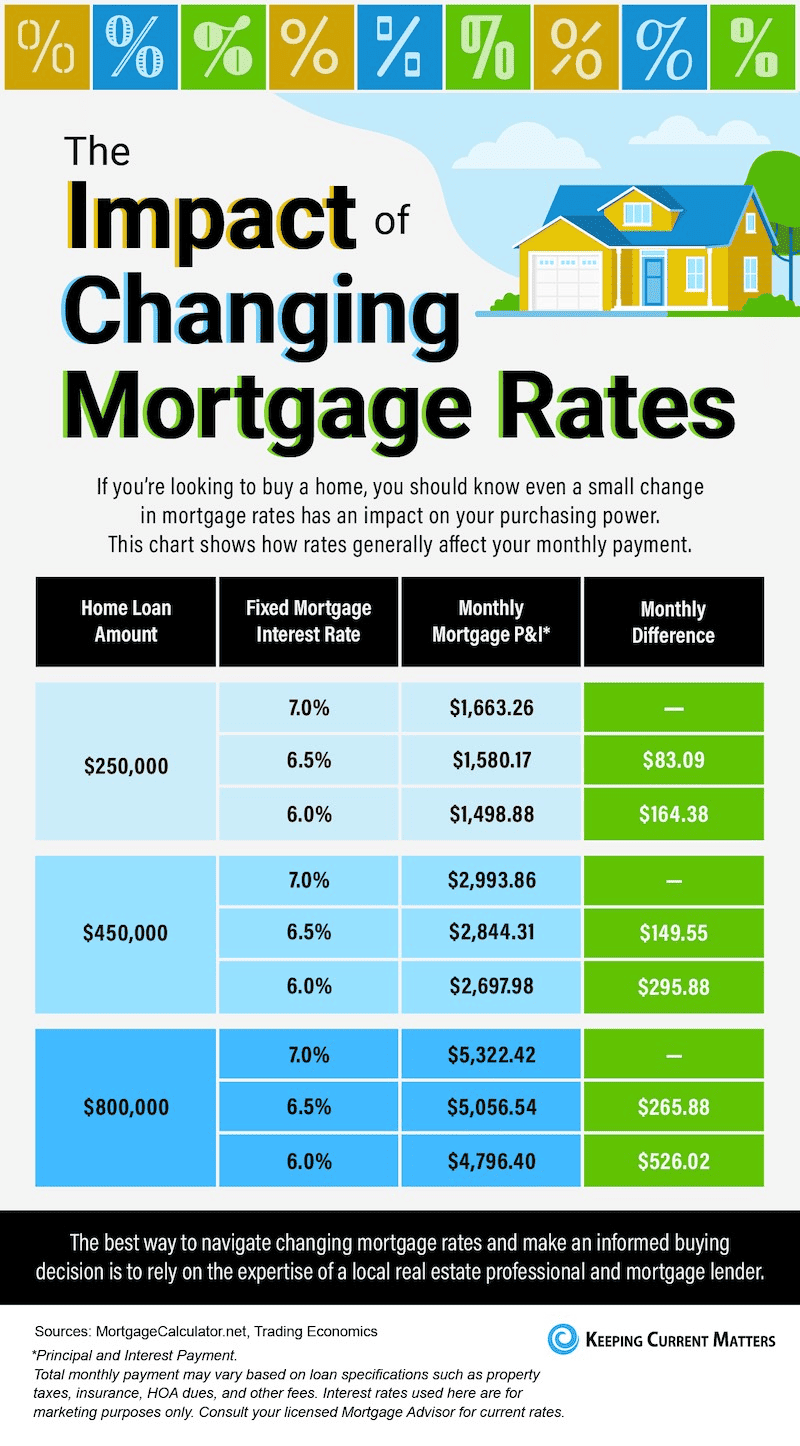

There’s been a lot of focus on higher mortgage rates and how they’re creating affordability challenges for today’s homebuyers. It’s true that rates climbed dramatically

As the housing market continues to change, you may be wondering where it’ll go from here. One factor you’re probably thinking about is home prices,

If you’re thinking about selling this spring, it’s time to get moving – the best week to list your house is fast approaching. Experts at

Our monthly real estate market report includes information about housing prices, inventory, mortgage rates, home sales and market predictions. We summarize news headlines and share

If you’re thinking about buying a home, you want to know the decision will be a good one. And for many, that means thinking about