If you’re currently renting and watching your monthly payments climb, you may be wondering if now is the time to buy a home. Recent data from Zillow suggests that in many metro areas across the U.S., monthly mortgage payments are now lower than rent payments. This trend is opening up a unique opportunity for potential homebuyers to secure a home for less than what they would pay in rent. Let’s dive into what this could mean for you as a potential buyer, and look at some specific examples to see just how much you could save by making the leap to homeownership.

Why Are Mortgage Payments Becoming More Affordable Than Rent?

Several factors are driving this shift. Mortgage rates, which had peaked in recent months, are starting to ease off, making borrowing more affordable. At the same time, home prices have leveled off or even dropped in some areas, and there’s more inventory on the market. These conditions make homeownership more accessible, and in certain metros, monthly mortgage payments on a typical home have dropped below monthly rent costs.

For renters who have been feeling the squeeze, this might be the perfect time to consider buying. Instead of spending more on rent with no long-term return, you could be building equity in a home that also costs less each month.

Metro Areas Where Buying Is Cheaper Than Renting

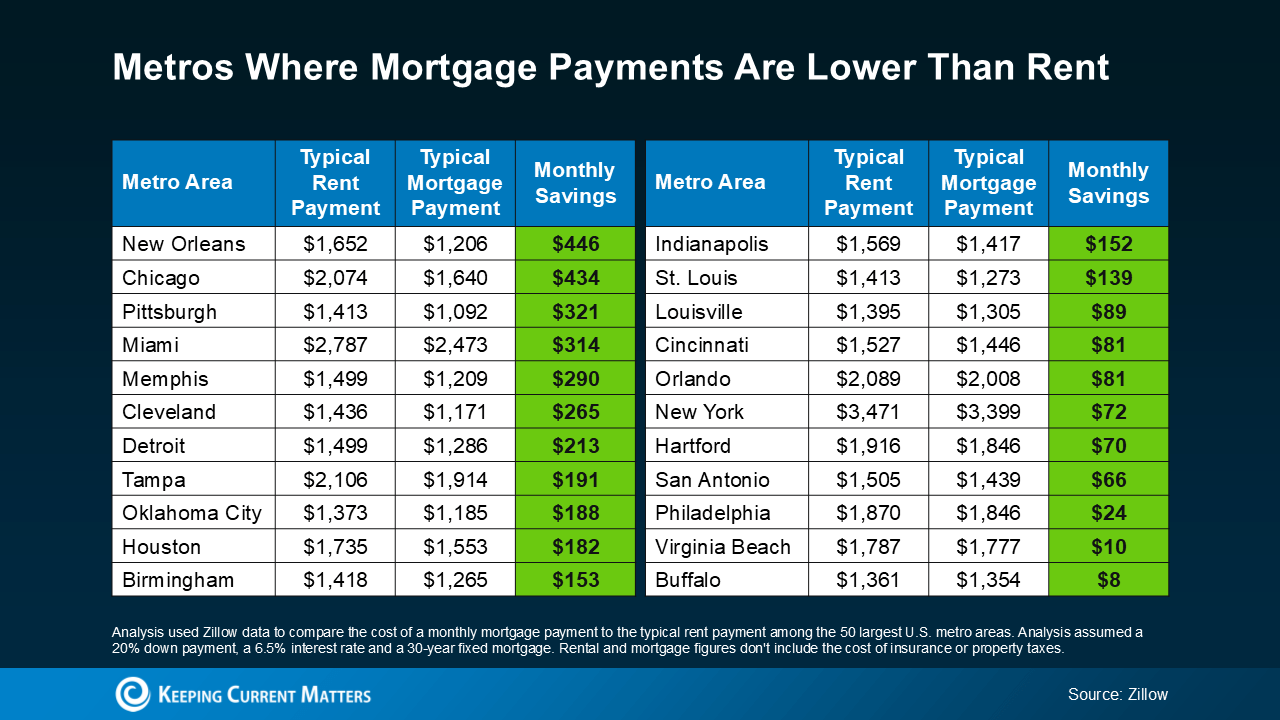

According to Zillow’s analysis, in 22 of the 50 largest U.S. metro areas, monthly mortgage payments are now lower than rent payments. Below are some key areas where buyers can see significant monthly savings.

Top Cities Where Homebuyers Could Save the Most

- New Orleans, LA

- Typical Rent Payment: $1,652

- Typical Mortgage Payment: $1,206

- Monthly Savings: $446

- Chicago, IL

- Typical Rent Payment: $2,074

- Typical Mortgage Payment: $1,640

- Monthly Savings: $434

- Pittsburgh, PA

- Typical Rent Payment: $1,413

- Typical Mortgage Payment: $1,092

- Monthly Savings: $321

- Miami, FL

- Typical Rent Payment: $2,787

- Typical Mortgage Payment: $2,473

- Monthly Savings: $314

In these cities, the potential savings from buying a home rather than renting range from about $300 to over $400 per month. For many buyers, these savings could make a big difference in monthly budgeting and could be redirected to other expenses or investments.

Other Noteworthy Metros with Big Savings

Several other metros also show meaningful savings for buyers:

- Memphis, TN: $290 in monthly savings

- Cleveland, OH: $265 in monthly savings

- Detroit, MI: $213 in monthly savings

- Tampa, FL: $191 in monthly savings

These areas may not save quite as much as the top four cities, but the monthly difference between rent and mortgage payments still makes buying a financially smart option for many.

Cities with Moderate Savings

Not all areas see large disparities between rent and mortgage payments, but there are still savings to be found. For example:

- Indianapolis, IN: Rent is $1,569 compared to a mortgage payment of $1,417, for savings of $152 per month.

- St. Louis, MO: Rent is $1,413 compared to a mortgage payment of $1,273, saving $139 per month.

- Louisville, KY: Rent is $1,395 compared to a mortgage payment of $1,305, saving $89 per month.

These savings may seem smaller, but over time, they can still add up to meaningful reductions in housing costs, especially when combined with the long-term benefits of homeownership.

What to Consider Before Buying

If you’re looking at these savings and feeling ready to make the leap, it’s important to remember a few other costs associated with homeownership. While these comparisons consider only the principal and interest payments on a mortgage, homeowners also need to budget for additional expenses, such as:

- Property taxes

- Homeowner’s insurance

- Maintenance and repairs

However, keep in mind that renters also face extra costs, like renter’s insurance, parking fees, and possibly even utilities. The added costs of homeownership can vary significantly depending on the area, property type, and your personal budgeting.

Why Homeownership Could Be a Smart Move Right Now

For those ready to commit, buying a home not only comes with potential monthly savings but also allows you to start building long-term wealth. Unlike rent, which provides no return on investment, mortgage payments help build equity, an asset that can appreciate over time. As Orphe Divounguy, a Senior Economist at Zillow, explains:

“… for those who can make it work, homeownership may come with lower monthly costs and the ability to build long-term wealth in the form of home equity — something you lose out on as a renter.”

With mortgage rates slowly decreasing and more homes available on the market, the current landscape may offer you a chance to buy a home that fits your budget better than a rental property.

Bottom Line: Is It Time to Make the Move?

If you’re feeling ready to stop renting and want to explore what buying a home could look like, consider connecting with a local real estate agent. They can provide more specific guidance on your area and help you evaluate whether buying is right for you. Even if your city isn’t on this list of metros with lower mortgage payments than rent, conditions could change quickly, and homeownership might soon become an even more attractive option.

The potential to save money each month and build equity makes buying a home a compelling choice for many renters today. It might be time to pull out your calculator and see if a mortgage payment could fit better in your budget than rent.

Mortgage Maestro Group – NMLS #1838215