Presidential election years affect the national housing market and mortgage rates as people prepare for economic and policy changes. Historically, existing home prices have increased in the last 7 of 8 presidential elections.

Presidential election years affect the national housing market and mortgage rates as people prepare for economic and policy changes. Historically, existing home prices have increased in the last 7 of 8 presidential elections.

Insights

“One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.

Jessica Lautz, Deputy Chief Economist, NAR

“Home sales have lingered at 30-year lows, and since 70 million more Americans live in the country now compared to three decades ago, it’s inevitable that sales will rise in coming years. Inventory will grow steadily from more home construction, and various life-changing events will require people to trade up, trade down or move to another location.

Lawrence Yun, Chief Economist, NAR

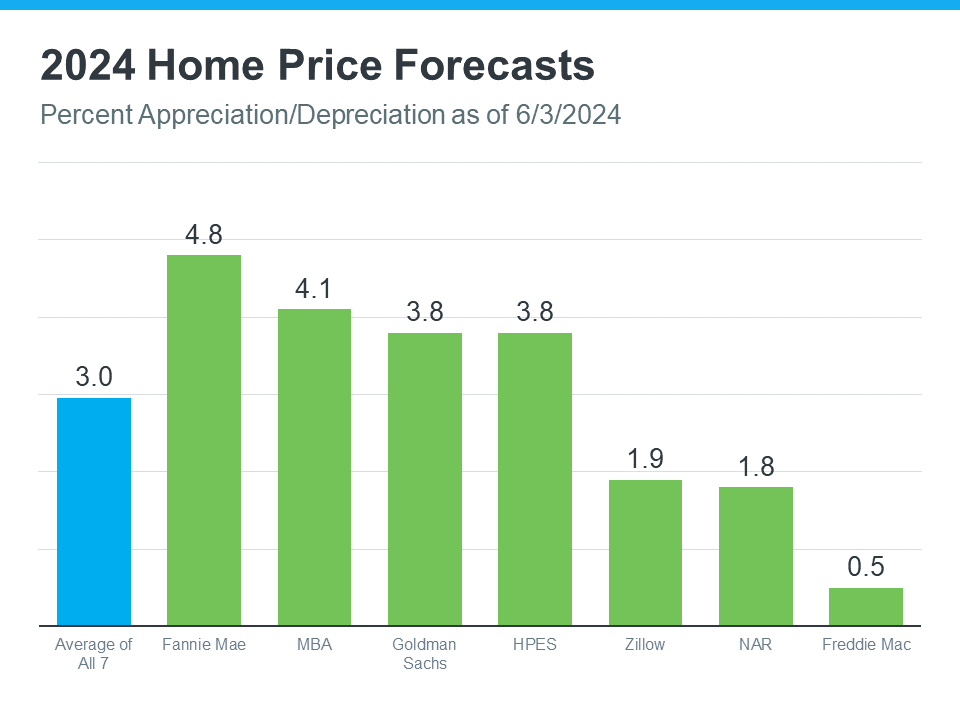

Forecasts

When it comes to the real estate forecast for the next 5 years, I’m cautiously optimistic. I believe we’re going to see a lot of ebb and flow over the next 5 years — some highs, some lows, but overall, a healthy market. Prices should continue to rise, though more slowly, and buyers might enjoy more options as inventory expands. But remember, real estate is profoundly local. What happens on a national scale can manifest differently in your backyard.

When it comes to the real estate forecast for the next 5 years, I’m cautiously optimistic. I believe we’re going to see a lot of ebb and flow over the next 5 years — some highs, some lows, but overall, a healthy market. Prices should continue to rise, though more slowly, and buyers might enjoy more options as inventory expands. But remember, real estate is profoundly local. What happens on a national scale can manifest differently in your backyard.

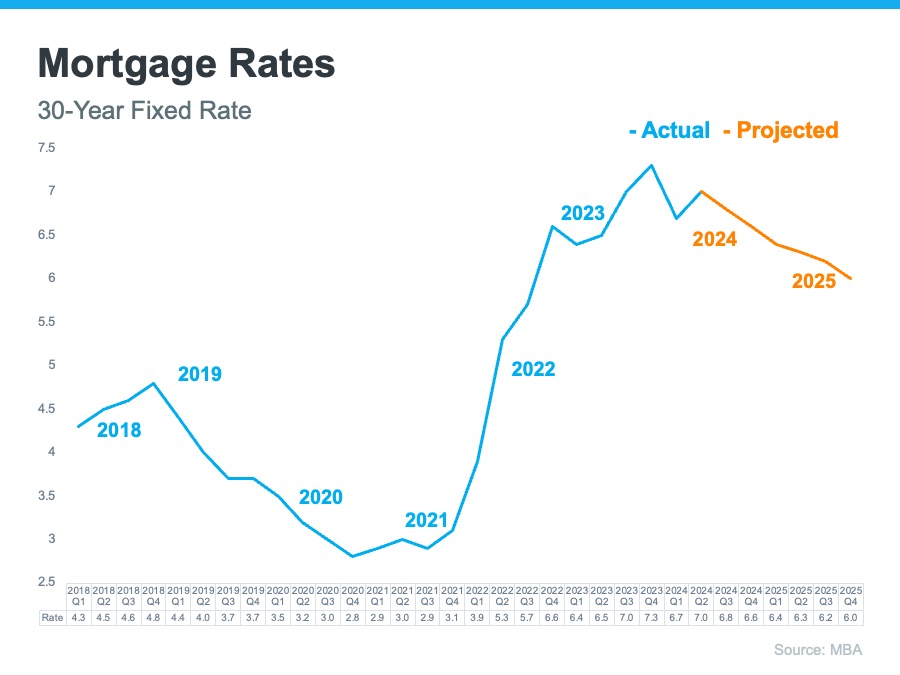

Rates

“Historically, mortgage rates have tended to drop in the period leading up to 8 of the last 11 presidential elections. Throughout the first half of 2024, inflation kept mortgage rates around 7 percent. Now encouraging inflation data and a cooling labor market have raised the chances of a Federal Reserve rate cut in September, with a possibility of another cut before the end of the year.

“Historically, mortgage rates have tended to drop in the period leading up to 8 of the last 11 presidential elections. Throughout the first half of 2024, inflation kept mortgage rates around 7 percent. Now encouraging inflation data and a cooling labor market have raised the chances of a Federal Reserve rate cut in September, with a possibility of another cut before the end of the year.

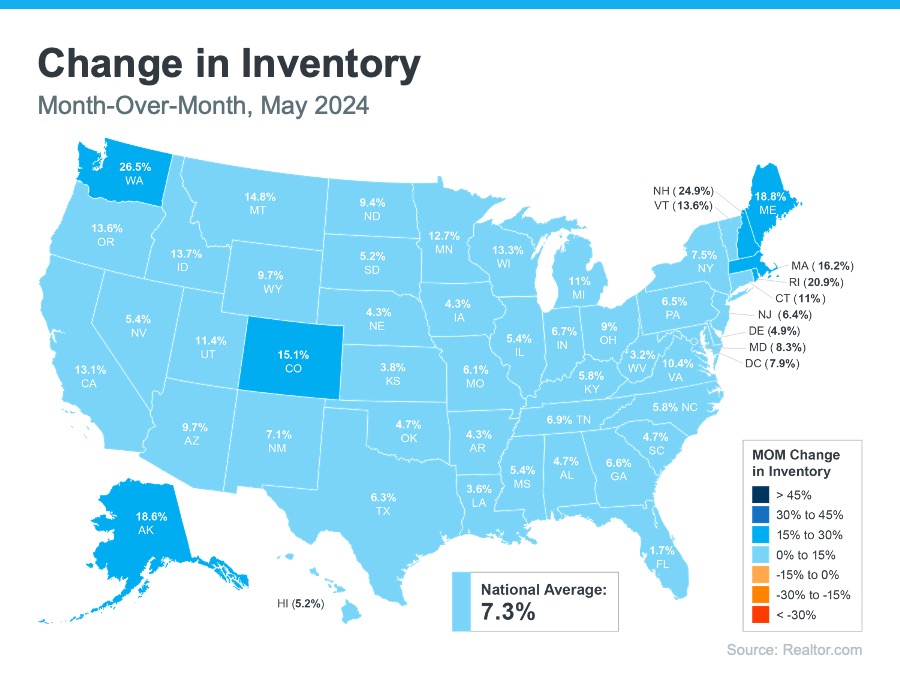

Inventory

The market is at an interesting point with rising inventory and lower demand. Supply and demand movements suggest easing home price appreciation in upcoming months. Inevitably, more inventory in a job-creating economy will lead to greater home buying, especially when mortgage rates descend.

The market is at an interesting point with rising inventory and lower demand. Supply and demand movements suggest easing home price appreciation in upcoming months. Inevitably, more inventory in a job-creating economy will lead to greater home buying, especially when mortgage rates descend.

Lawrence Yun, Chief Economist, NAR

Prices

Realtor.com reports that in June 2024, the median home price remained steady at $445,000, reflecting a 4% increase from the prior year. Meanwhile, the median price per square foot rose by 3.4%, suggesting an increase in the availability of more affordable homes. Additionally, homes spent an average of 45 days on the market in June 2024, two days longer than the same period last year.

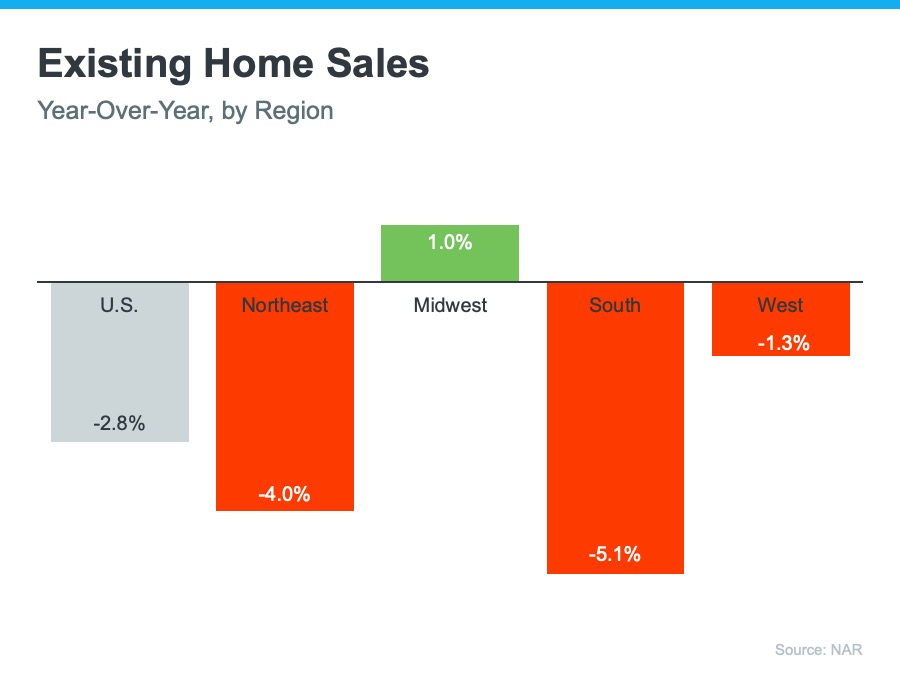

Sales

Usually, home sales are unchanged compared to a non-election year with the exception being November. In an election year, November is slower than normal. In December, following an election, and in the following year, the sales that are lost during November are recovered.

Usually, home sales are unchanged compared to a non-election year with the exception being November. In an election year, November is slower than normal. In December, following an election, and in the following year, the sales that are lost during November are recovered.

Ali Wolf, Chief Economist, Zonda

More Charts…

Do you love housing data? Whether you are a real estate expert or just learning about the market, this is the housing data to know. Enjoy 50+ charts illustrating the key metrics for the month.

Do you love housing data? Whether you are a real estate expert or just learning about the market, this is the housing data to know. Enjoy 50+ charts illustrating the key metrics for the month.

Monthly Housing Market Report (PDF)

Mortgage Maestro Group – NMLS #1838215