By Raymond Williams, Leading Mortgage Broker in Denver, CO

Denver, the Mile High City’s dynamic epicenter, capped 2025 with a market exhibiting subtle yet promising shifts: Inventory levels broadened to 3-4 months’ supply – up from a constrained 2.5 – while pending sales accelerated 10% in the closing months, countering a 2% softening in closed transactions as rates held firm. Perched against the Rocky Mountains with its fusion of craft breweries in RiNo, tech hubs in LoDo, and outdoor gateways to the Front Range, this Denver County powerhouse lures young professionals, families, and transplants from pricier coasts, balancing urban energy with suburban sprawl in enclaves like Washington Park and Highlands Ranch. As 2026 arrives, compilations from the National Association of Realtors (NAR), Mortgage Bankers Association (MBA), Fannie Mae, and Colorado-specific projections from the Denver Metro Association of Realtors (DMAR) and local analyses herald a year of balanced resurgence. With mortgage rates tempering and inventory normalizing, this in-depth forecast leverages these sources to examine rate evolutions, price appreciations, sales volumes, origination upswings, and Denver-tailored elements – like cannabis industry growth and wildfire preparedness – to equip Mile High buyers and refinancers for a landscape of measured opportunity.

National Mortgage Rate Trends Shaping 2026

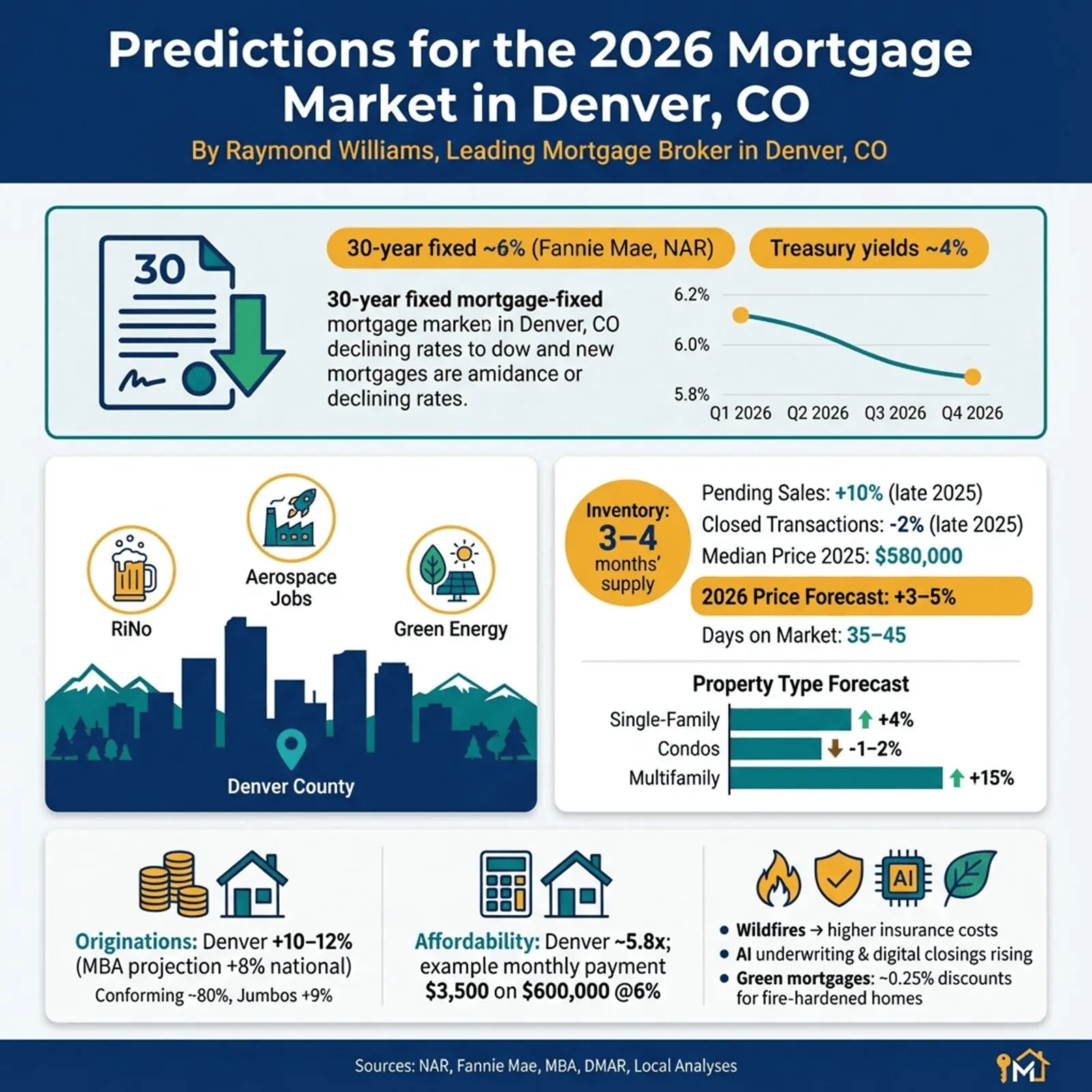

The U.S. mortgage sector in 2026 is forecasted to stabilize with modest downward pressure, easing the affordability bind without a full retreat to pandemic lows. Fannie Mae anticipates the 30-year fixed-rate mortgage averaging 6% across the year, edging to 5.9% by December from 6.2% in late 2025, predicated on the Federal Reserve’s funds rate lingering near 3% and inflation dipping to 2.3%. NAR’s Chief Economist Lawrence Yun projects a parallel 6% average, a decline from 6.7% in 2025, stressing that this equilibrium – augmented by ARM resets potentially under 6% – will foster buyer acclimation and refinancing as Treasury yields hold steady around 4%. The MBA outlines 6-6.5% ranges, with optimistic scenarios to 5.5% on further cuts but cautions against tariff-induced inflation pushing 0.25% higher.

In Denver, this national poise resonates with fixed-rate fidelity among tech workers at Lockheed Martin and brewers in Berkeley. Colorado’s conforming limit ($766,550) suits 85% of deals, but the metro’s jumbo segment – rising 8% for $700,000+ in Cherry Creek – may pivot to hybrids; brokers ought to advocate buydowns, considering closing costs at 2-3% and property taxes averaging 0.7%.

Home Prices and Sales Volume: Front Range Revival

Nationally, 2026 pivots from pause to progress. NAR envisions median prices advancing 4% post-3% in 2025, with existing-home sales vaulting 14% to 5.3 million units – the sharpest rebound since 2021 – as inventory swells 5-10% and pent-up millennial demand (40% of buyers) activates. Fannie Mae adjusts sales to 7.3% growth and prices to 0.4%, yet Zillow’s updated view signals +0.4% appreciation, underscoring Rocky Mountain appeal. HomeLight identifies 25 hottest 2026 markets, with Denver ranking high on job influx and views.

Colorado’s Front Range, led by Denver, charts controlled optimism: DMAR data pegs 2025 medians at $580,000, with 2026 forecasts from Corken + Company calling for 3-5% growth to $597,400-$609,000, propelled by 20,000 jobs in aerospace and green energy. Sales may escalate 10-12%, with inventory at 3.5-4 months’ supply (up from 2.8) enabling bids below ask; single-family homes in Stapleton appreciate 4%, while condos in Capitol Hill lag 1-2% amid 15% multifamily surge. Days on market: 35-45, up from 30; Austin and California inflows (25% of demand) bolster velocity, though wildfire zones in Golden trim 4% of listings.

Mortgage Originations: Mile High Uptick

Originations emerge as a catalyst, with MBA projecting 8% national climb to $2.2 trillion in single-family volumes, 5.8 million loans – 80% purchases. Fannie Mae: $2.32 trillion, refis 20%.

Denver’s 10-12% local surge harnesses Colorado’s momentum, with conforming 80%; jumbos +9% for $800,000+ in LoDo. First-timers (30%) utilize CHFA for 3% downs.

Affordability and Buyer Sentiment in Focus

National ratios: 5.5x. Denver’s 5.8x challenges: $3,500 monthly on $600,000 at 6% tests $110,000 medians, plus 10% insurance from fires. 65% buyers buoyant, per NAR, with millennials (35%) chasing Five Points and retirees (18%) Lakewood. Renewals hit 22%.

Emerging Trends: Technology and Sustainability

AI underwriting in 7 days, 40% digital. Green mortgages with 0.25% discounts for fire-hardened homes rise 18% via CO incentives.

Key Challenges on the Horizon

Supply deficits 10%; regs bar 5%. Locally, wildfires inflate insurance 12%; tech layoffs loom.

Looking Ahead: Denver’s Elevated Equilibrium

2026 elevates Denver’s market to balanced heights, with rates and volumes tempering prices. Front Range foresight forges paths upward.