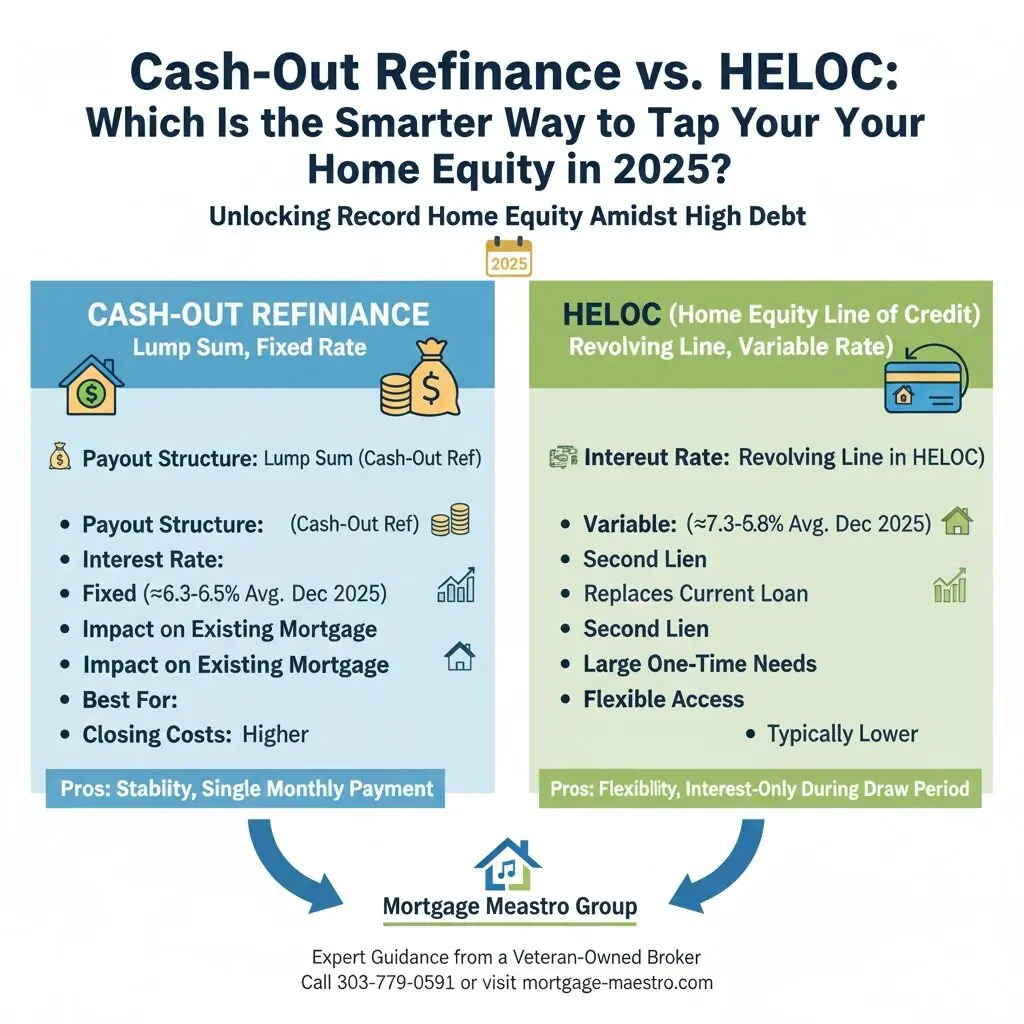

Cash-Out Refinance vs. HELOC: Which Is the Smarter Way to Tap Your Home Equity in 2025?

Homeowners across Colorado, California, Florida, Texas, and Wyoming are sitting on record levels of home equity—often over $250,000 on average—while facing high-interest credit card debt