Homeowners across Colorado, California, Florida, Texas, and Wyoming are sitting on record levels of home equity—often over $250,000 on average—while facing high-interest credit card debt and rising costs. With consumer debt soaring and many carrying balances at rates above 20%, it’s no wonder more people are looking to their home equity for relief.

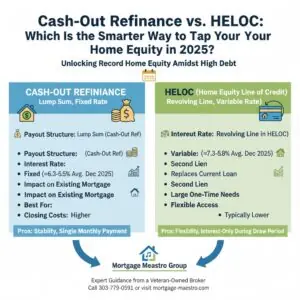

But what’s the best way to access that equity: a cash-out refinance or a home equity line of credit (HELOC)? The answer depends on your goals, timeline, and financial situation.

At Mortgage Maestro Group, a veteran-owned independent mortgage broker based in Denver, CO, we’ve guided hundreds of clients through these decisions. Led by Navy veteran Ray Williams (NMLS #216267) with over 20 years of experience since 2002, our team specializes in stress-free solutions like cash-out refinances and debt consolidation using home equity.

Watch Ray break it down in this helpful video:

What Is a Cash-Out Refinance?

A cash-out refinance replaces your existing mortgage with a new, larger one. You receive the difference between the new loan amount and your current balance as a lump-sum cash payout.

This option works well for large, one-time expenses like home renovations, paying off high-interest debt, or investing in another property. It provides a fixed interest rate for predictability, and in today’s market (as of December 2025), 30-year fixed refinance rates average around 6.3-6.4%.

However, if your current mortgage has a low rate (like many from a few years ago), refinancing the entire balance could mean a higher “blended” rate overall.

What Is a Home Equity Line of Credit (HELOC)?

A HELOC acts like a credit card backed by your home’s equity. You get approved for a credit limit and can draw funds as needed during the draw period (typically 10 years), paying interest only on what you borrow.

HELOCs offer flexibility—perfect for ongoing expenses, emergencies, or if you’re unsure how much you’ll need. Current average HELOC rates in December 2025 hover around 7.5-7.8%, variable and tied to the prime rate.

The big advantage? It leaves your existing low-rate first mortgage untouched, potentially keeping your overall borrowing costs lower.

Cash-Out Refinance vs. HELOC: Side-by-Side Comparison

Here’s a clear breakdown to help you decide:

| Feature | Cash-Out Refinance | HELOC |

| Payout Structure | Lump sum at closing | Revolving credit line (draw as needed) |

| Interest Rate | Fixed (predictable payments) | Variable (can rise or fall) |

| Current Avg. Rate (Dec 2025) | ~6.3-6.5% (slightly higher for cash-out) | ~7.5-7.8% |

| Impact on Existing Mortgage | Replaces your current loan | Second lien; keeps your first mortgage intact |

| Best For | Large one-time needs, debt consolidation, long-term homeownership | Flexible access, short-term needs, upcoming home sale, investments |

| Closing Costs | Higher (full refinance process) | Typically lower |

| Payment Flexibility | Fixed principal + interest | Interest-only during draw period |

| Risk | Higher rate if replacing low-rate mortgage | Rate increases possible |

Pros and Cons of Each Option

Cash-Out Refinance Pros:

- Fixed rate and payment for stability.

- Potential tax-deductible interest (consult a tax advisor).

- Single monthly payment (combines everything).

Cons:

- Resets your entire mortgage—potentially losing a low rate.

- Higher closing costs and longer process.

- Less flexible if plans change.

HELOC Pros:

- Borrow only what you need, pay interest only on that amount.

- Preserves your low-rate first mortgage.

- Interest-only payments during draw period (great for short-term use).

- Ideal for upcoming moves—open early to access equity without trapping it in the home.

Cons:

- Variable rates could increase payments.

- Requires discipline (revolving credit can tempt overspending).

- Becomes a second payment on top of your mortgage.

In 2025, with mortgage rates stabilizing around the mid-6% range and HELOC rates in the high-7% range, many homeowners find HELOCs more attractive to avoid disturbing ultra-low existing rates.

When to Choose Cash-Out Refinance

- You need a large lump sum (e.g., $100,000+).

- You’re consolidating significant debt and want one predictable payment.

- You plan to stay in the home long-term (10+ years).

- You’re investing in rental properties or major renovations.

We’ve helped many clients use cash-out refinances for debt consolidation, turning high-interest credit card payments into lower, tax-advantaged mortgage payments.

When to Choose a HELOC

- You want flexibility for ongoing or unknown expenses.

- You’re planning to sell in the next few years (interest-only payments keep cash flow strong).

- You need funds for investments (e.g., down payment on a rental or fix & flip).

- You have a low-rate first mortgage you don’t want to touch.

Pro Tip from Ray: Open a HELOC before listing your home. Once the house is on the market, lenders may hesitate, leaving your equity “trapped” until closing.

Real-World Examples from Our Clients

A Colorado veteran used a HELOC to pay off $40,000 in credit card debt, dropping their monthly minimums dramatically while keeping their 3% VA loan intact.

An investor client drew from their HELOC for down payments on short-term rentals, building wealth without refinancing their primary residence.

A self-employed borrower in the cannabis industry tapped a HELOC for business growth—something big banks often overlook.

How Mortgage Maestro Group Makes This Decision Stress-Free

As an independent broker with access to multiple lenders, we shop the best rates and terms for cash-out refinances, HELOCs, and hybrid solutions. Our “high tech and high touch” approach means clear explanations, no surprises, and ongoing support—even after closing.

Whether you’re a first-time refinancer, veteran exploring VA options, investor with DSCR needs, or someone consolidating debt, we treat your loan like our own. Our 5-star reviews praise our transparency, patience, and street-fighter advocacy for clients.

In states like Colorado, California, Florida, Texas, and Wyoming, local market nuances matter—we know them inside out.

Ready to Unlock Your Home Equity the Smart Way?

Don’t guess which option is best for you in 2025. Let our experts review your situation and run the numbers side by side.

Call us today at 303-779-0591 or book your free consultation at https://mortgage-maestro.com/appointments/.

We put your bottom line first—and the dream of building wealth through homeownership never gets old.

For more resources:

- Refinance Options

- Debt Consolidation

- Loan Options

- Mortgage Calculator

- The Truth About Mortgages

- FAQs

¡Hablamos español! Visit https://mortgage-maestro.com/hablamos-espanol/ for support.

Key Points

- Cash-out refinances provide a lump-sum payout with fixed rates, ideal for large, one-time needs or long-term debt consolidation.

- HELOCs offer flexible, revolving access with potential interest-only payments—often better for short-term needs or preserving a low-rate first mortgage.

- As of December 2025, average rates favor strategies that avoid refinancing low existing mortgages; HELOCs average 7.5-7.8%, while cash-out refi rates align closer to 6.3-6.5%.

- The right choice depends on your timeline, amount needed, and plans—consult an expert to avoid costly mistakes.

- Mortgage Maestro Group specializes in both options, with personalized guidance for veterans, investors, self-employed borrowers, and more.

Deeper Insights into Cash-Out Refinance and HELOC Strategies

Many homeowners overlook how these tools interact with current market conditions. With 30-year fixed rates holding in the low-to-mid 6% range after recent stabilization, replacing a sub-4% mortgage via cash-out refinance can significantly increase long-term costs.

HELOCs, tied to the prime rate, have seen averages around 7.5-7.8% but offer the advantage of borrowing selectively. During the draw period, interest-only payments can dramatically improve cash flow—especially useful for investors using funds for fix & flip projects or rental acquisitions.

For debt consolidation, both options shine, but HELOCs often win for smaller amounts ($25,000-$50,000) due to lower closing costs and flexibility. Larger consolidations might favor cash-out for the fixed rate and single payment.

Market Trends Impacting Your Decision in 2025

Rates have remained relatively stable heading into late 2025, with 30-year fixed mortgages averaging around 6.3%. Cash-out refinances typically carry a slight premium over rate-and-term refinances, pushing effective rates higher.

HELOC rates, while variable, provide a hedge if further rate cuts materialize. Many experts anticipate modest declines if economic conditions soften.

In growing markets like Denver and across our licensed states, rising home values continue building equity—making now a strategic time to plan access.

Advanced Considerations

- Tax Implications: Interest on both may be deductible if used for home improvements (always verify with a tax professional).

- LTV Limits: Cash-out typically maxes at 80% loan-to-value; HELOCs can go higher depending on the lender.

- Closing Timelines: Cash-out refinances take 45-60 days; HELOCs often close in 30 days or less.

- Hybrid Approaches: Some clients start with a HELOC, then consolidate into a cash-out later if rates drop.

At Mortgage Maestro Group, we run detailed scenarios using current rates from our wholesale lender network—ensuring you get the most advantageous structure.

Whether exploring Colorado home loans, VA cash-out options in Texas, or self-employed refinance solutions, our transparent, educational approach demystifies the process.