Are you in a situation where you own valuable assets but have limited cash? Maybe you have the bulk of your assets in the equity of your home? Or you wanted to know how does a Reverse Mortgage loan work? This is common for many people over 60. As you enter retirement, your financial situation may change, making it challenging to manage expenses without your previous salary.

However, retirement doesn’t have to mean financial stress. You deserve to enjoy this stage of life fully, considering all your hard work over the years. If you’re thinking about home renovations, vacations, purchasing a new vehicle, or covering general living and medical costs, a reverse mortgage loan could be a helpful solution.

What is a Reverse Mortgage Loan?

Tom Selleck once described a reverse mortgage loan as “A loan that allows you to convert part of the equity in your home into cash without having to sell your home or pay additional monthly bills.”

A reverse mortgage loan is a loan that allows homeowners to get cash from their home’s value without monthly repayments. Repayment only happens when you pass away, move out, or sell your home.

The most popular type is the Home Equity Conversion Mortgage (HECM), insured by the Federal Housing Administration (FHA).

Reverse Mortgage Loans vs. Traditional Loans

Regular loans involve paying back what you owe over time, increasing your home ownership. However, with a reverse mortgage loan, no regular payments are required, and the debt grows with withdrawn money and accumulated interest, reducing your home ownership.

Repayment is only due upon leaving your home, and there are no penalties for early interest payments, giving you flexibility based on your preferences.

How Does A Reverse Mortgage Loan Work

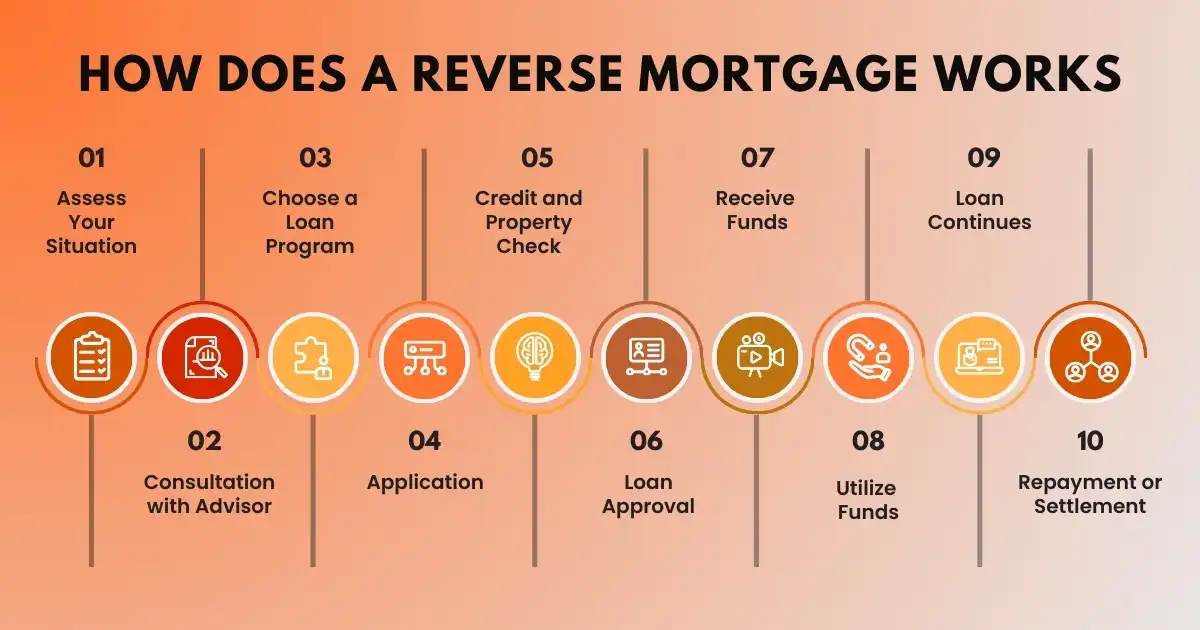

1. Assess Your Situation

If you own a house and have paid off most or all of your mortgage, and you need extra cash, consider a reverse mortgage loan. It’s like borrowing money from the value of your home, and you don’t have to make monthly payments. Instead, the loan is repaid when you sell the house, move out, or pass away.

2. Consultation with Advisor

Before making any decisions about a reverse mortgage loan, it’s important to talk with a reverse mortgage advisor. They can provide expert guidance, explain your options clearly, and help you choose a lender and plan that suits your needs and circumstances.

This consultation is important for making informed decisions about your financial future. As part of obtaining a reverse mortgage loan you will be required to go through an educational process to make sure you see benefit for you to move forward. The reverse mortgage loan are designed to protect you.

3. Choose a Loan Program

After talking with the advisor, you’ll pick the best loan program that matches what you want to do with your money and your home. This program will outline the terms and conditions of your reverse mortgage loan, including how much money you can receive and when you need to repay it.

4. Application

To apply for a reverse mortgage loan, you need to submit the required documents and information to the lender. This usually includes things like proof of income, property taxes, insurance, and any other details the lender asks for.

They’ll review your application to determine if you qualify for the chosen reverse mortgage loan program.

5. Credit and Property Check

Before getting a reverse mortgage loan, the lender will look at your credit history to see if you’ve paid your bills on time in the past. They’ll also check how much your home is worth. Based on these factors, they’ll decide how much money you can borrow.

6. Loan Approval

Once your application is reviewed and your home’s value is assessed, the lender will approve your reverse mortgage loan if everything checks out. This means you can access the cash you need while still living in your home.

7. Receive Funds

With a reverse mortgage loan, you can get the money in a few ways. You might choose to receive it all at once, like a big chunk of cash. Or you could have it set up as a line of credit, where you can take out money as you need it.

There’s also the option of getting regular payments, like a monthly check. It all depends on what you want and what’s agreed upon in the loan terms.

8. Utilize Funds

After securing a reverse mortgage loan, you can utilize the funds according to the loan agreement. However, keep in mind that certain loans may have restrictions on how the money can be spent, such as for home improvements or covering specific expenses.

It’s essential to understand these terms before proceeding with the loan.

9. Loan Continues

With a reverse mortgage loan, you keep getting money from the lender as long as you live in your home. You don’t have to make any payments on the loan until you no longer live in the house. When you move out or pass away, the loan must be repaid, usually by selling the home.

10. Repayment or Settlement

Once you or your family move out of the house, you can decide how to handle the loan. You might choose to repay the loan amount, which includes the money you received plus interest, or you can sell the house to pay off the loan.

If the house sells for more than what you owe, you or your family can keep the extra money. If it sells for less, you won’t have to pay the difference.

Reverse Mortgage Loan Requirements

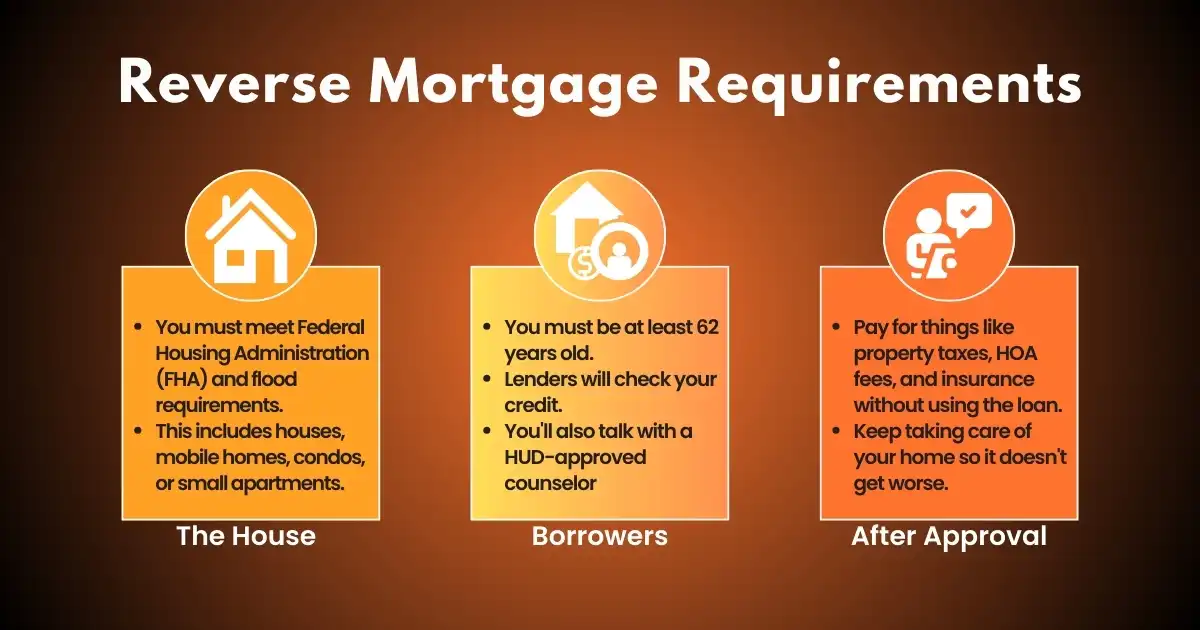

The rules for a reverse mortgage loan vary based on the loan you choose. The popular one, called the home equity conversion mortgage (HECM), has specific guidelines.

- The House: Your main residence, whether fully owned or with substantial equity, must meet Federal Housing Administration (FHA) and flood requirements. This includes houses, mobile homes, condos, or small apartment units where you reside.

- Borrowers: To get a reverse mortgage loan, you must be at least 62 years old. Lenders will review your credit, including payment history for mortgages, credit cards, and loans. You’ll also meet with a HUD-approved counselor to discuss the process.

- After Approval: Make sure you can cover expenses like property taxes, HOA fees, and insurance without relying on the loan. It’s also important to maintain your home to prevent it from deteriorating.

Consult A Money Expert About Reverse Mortgage Loan

Interested in How Does A Reverse Mortgage loan Work? It’s a way for older homeowners to access cash without monthly payments or selling their homes. However, there are important considerations such as property maintenance and taxes.

Schedule a consultation today to guide you through the process and help you determine if a reverse mortgage loan aligns with your financial goals. Reach out to them today for expert advice and personalized assistance!

Final Thoughts

How Does A Reverse Mortgage loan Work? A reverse mortgage loans might help older homeowners who need more money. With it, you can use your home’s value for cash without paying back each month or selling your home. But remember, there are downsides like needing to take care of your home, pay for insurance, and property taxes. Talk to a money expert to see if a reverse mortgage is right for you.

FAQs

How much can you get from a Reverse Mortgage Loans?

How much cash you get from a reverse mortgage loans depends on the borrower’s age, interest rates, and home value. Older borrowers and lower rates mean you get more money, while younger borrowers or higher rates mean less.

Who owns the house on a Reverse Mortgage Loan?

The amount you get from a reverse mortgage loan depends on how old the youngest borrower is, the interest rates, and your home’s value. Older ages and lower rates mean you could get a higher percentage of your home’s value as a loan.

How does a Reverse Mortgage get paid back?

A reverse mortgage loan gets repaid when it’s due or if the homeowner sells their home or pays it off differently. When the borrower dies, their heirs can either pay off the loan to keep the property or sell the home to settle the loan. If the loan balance is more than the home’s value, heirs can pay it off at 95% of the current value, even if it’s less than what’s owed.

Can I sell my house if I have a Reverse Mortgage Loan?

Yes, you can sell your house anytime when you have a reverse mortgage loan, and there is no prepayment penalty.

Mortgage Maestro Group – NMLS #1838215