Owning a home is a big part for lots of people in America, and there’s a good reason why. It gives you financial safety, stability, and the freedom to make your home just the way you like it.

A report discovered that 70% of Americans consider buying a home in 2024 to be unrealistic. This outlook is primarily influenced by challenging economic conditions, with 63% of Americans indicating they cannot afford a home. Younger generations are particularly affected, as 87% of Gen Z and 62% of Millennials report being unable to afford a home at this time.

Historically, owning a home has provided long-term financial stability. Home values tend to increase over time, allowing owners to borrow against their home’s value. Sure, there are chores like upkeep, but the benefits are worth it.

10 Advantages of Home Ownership

Owning a home means stability, security, and feeling like you belong for a lot of people, and it’s a big milestone in life. Apart from the good feelings, having a home brings lots of money benefits that help you build wealth and grow as a person. Here are the advantages of homeownership:

1. Your Monthly Payments Stay Steady

If you rent a house or apartment, your landlord might increase your rent anytime, leaving you unsure about how much you’ll pay. But with homeownership, especially with a fixed-rate mortgage, you know your monthly payments in advance. This stability helps you plan your budget better and reduces worries about unexpected changes.

For example, When you buy a house with a fixed-rate mortgage, like paying $1,500 every month, your payments stay the same which could be a long time like 15, 20, or 30 years.

Unlike renting, where your rent can go up each year, this stability helps you plan your budget and future without worrying about changes in housing costs. That’s the first on the list of our Advantages Of Home Ownership.

2. You Can Save Money Over Time

Even though buying and taking care of a home costs money, having the same monthly payments can be cheaper than facing higher rent every time you renew your lease. Rent going up or paying a lot for a new place can really hurt your budget.

Imagine you pay $1,200 a month for rent. Every year, the landlord raises it by $50. After five years, you’re paying $250 more each month. But if you bought a home with a $1,200 monthly mortgage, your payments would stay the same.

Although owning a home has its own costs like maintenance and taxes, having steady payments can save you money over time compared to dealing with rising rent.

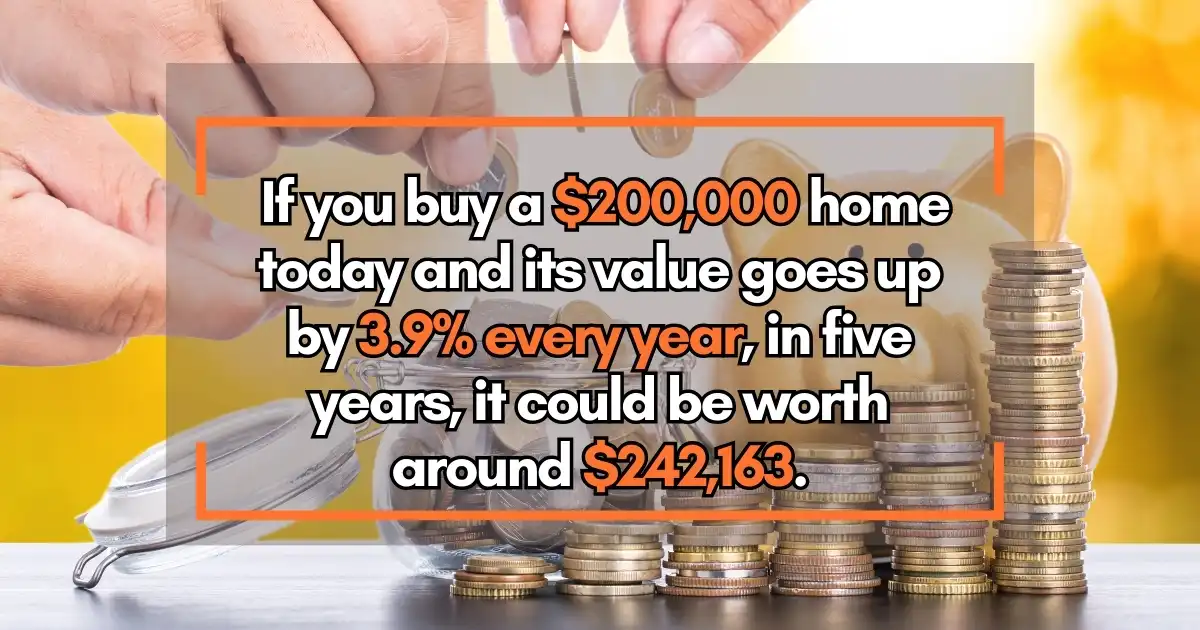

3. You Can Grow Your Wealth

Buying a home is like investing because its value usually goes up over time. For example, if you buy a $200,000 home today and its value goes up by 3.9% every year, in five years, it could be worth around $242,163.

This is a benefit you don’t get from renting, where you spend money without gaining anything in return.

4. You Can Grow Equity

What’s equity? It’s how much your asset is worth minus what you owe on it. You can increase home equity in two ways:

- Pay your monthly mortgage, which lowers what you owe.

- Your home might go up in value over time, making it worth more.

Renters miss out on this opportunity because their monthly payments only cover the cost of living there, without any potential for long-term wealth building.

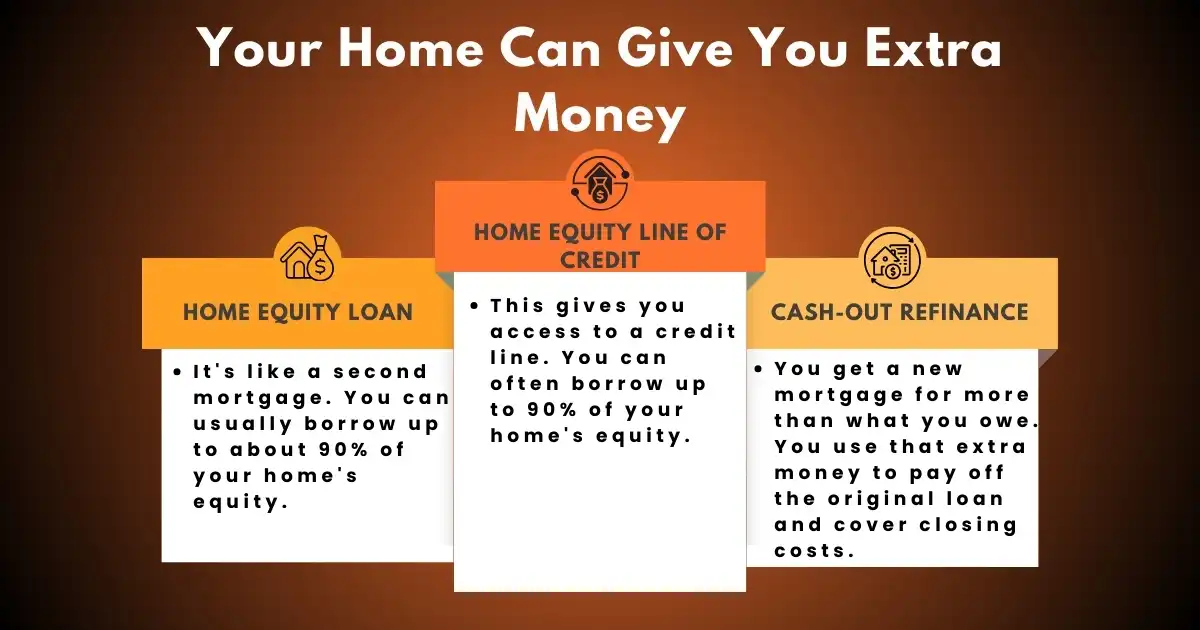

5. Your Home Can Give You Extra Money

Building equity means you can use your home’s value to get cash. Here are some ways:

- Home Equity Loan: It’s like a second mortgage. You can usually borrow up to about 90% of your home’s equity.

- HELOC (Home Equity Line of Credit): This gives you access to a credit line. You can often borrow up to 90% of your home’s equity.

- Cash-Out Refinance: You get a new mortgage for more than what you owe. You use that extra money to pay off the original loan and cover closing costs, and you keep the rest. Typically, you can borrow up to 80% of your home’s equity.

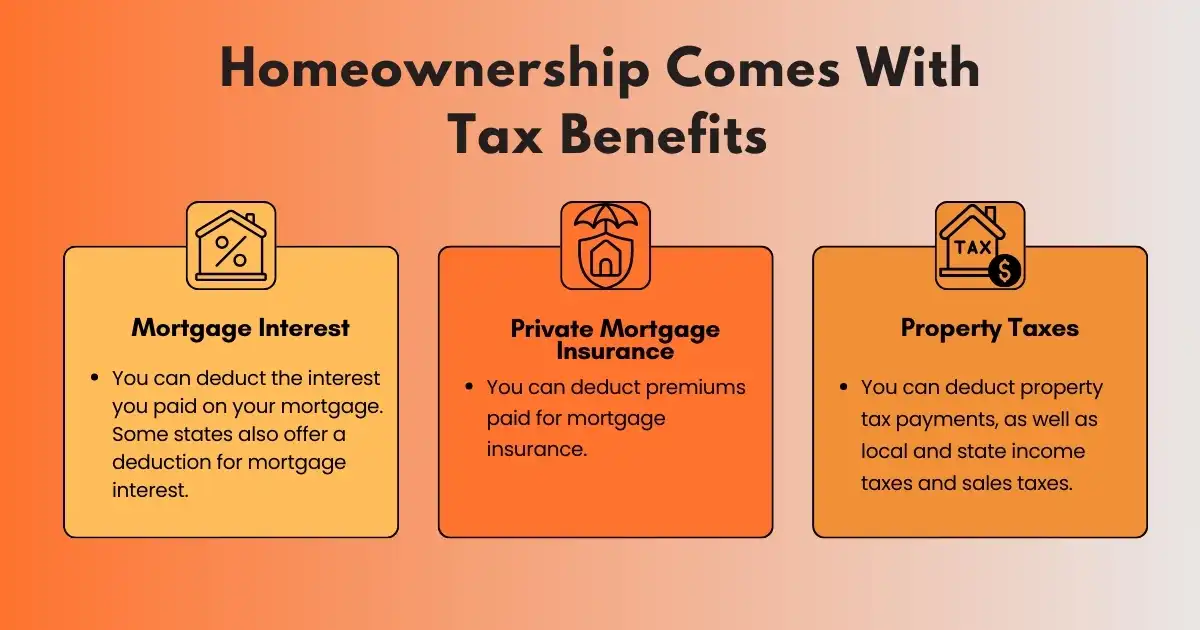

6. Homeownership Comes With Tax Benefits

Unlike renters, homeowners can enjoy various tax breaks. If you itemize deductions on your federal tax return, you might be eligible for the following:

- Mortgage Interest: You can deduct the interest you paid on your mortgage. Some states also offer a deduction for mortgage interest.

- Private Mortgage Insurance: You can deduct premiums paid for mortgage insurance.

- Property Taxes: You can deduct property tax payments, as well as local and state income taxes and sales taxes.

Additionally, when you sell your home in the future, you might not have to pay capital gains taxes on the profit, depending on how much you made. It’s a good idea to speak with a tax advisor to understand how buying a home can affect your taxes.

7. You Can Improve Your Credit

Your credit score is influenced by how timely you pay your bills, including your mortgage. Making your mortgage payments on time can boost your credit score and make it easier to get loans in the future.

For example, you have a credit card bill and a mortgage to pay each month. If you always pay them on time, your credit score can go up. This makes it easier for you to borrow money later on if you need to.

8. You Can Make Your Home Yours

Around 65.9% of households in America own their homes, showing how important it is for stability and the ‘American Dream’.

The best part of owning a home is making it unique to you. Unless your neighborhood has strict rules from a homeowners association, you can change your space however you want. That means knocking down walls, adding rooms, and decorating just how you like. Renters don’t get this freedom. Plus, fixing up your home might raise its value, which is a bonus for you.

9. Living In A Home Lets You Become Part Of The Community

Did you know that living in a home allows you to become part of the community around you? Whether it’s chatting with neighbors, participating in local events, or contributing to neighborhood initiatives, being a homeowner often brings opportunities to connect and engage with the community in meaningful ways.

Homeowners often stay put for longer periods, which helps create a stronger sense of pride and stability in the neighborhood. When everyone works together to keep the area nice, it can even make your property worth more. A great addition to the Advantages Of Home Ownership.

10. You Can Learn More About Money

Owning a home can teach you a lot about money. For example, when you’re responsible for paying the mortgage every month, it helps you learn to budget and manage your finances effectively. You also get to see how property values change over time, which can give you insights into the real estate market and investments. Plus, handling unexpected repair costs teaches you the importance of having an emergency fund and planning for unforeseen expenses, a great addition to the Advantages Of Home Ownership.

Buying a house and managing mortgage payments and upkeep involve many steps. Parents can share what they know to teach their kids about money. Knowing how to manage money well is really important.

Secure Your financial Future And Become A Homeowner

Not everyone should own a home. If your job needs you to move often or you’re still working on improving your credit, renting might be better. But for many people, owning a home is the smartest choice. It gives you lots of freedom and lets you build equity in a property that will likely increase in value.

This means part of what you pay for housing becomes an investment in your future. If you’re ready to buy a home, fill out an application to guide you through the process.

Final Thoughts

In Advantages Of Home Ownership, there are many reasons why owning a home can be a smart choice. Along with building equity, enjoying tax benefits, and having stability and control, homeownership also encourages saving money, fosters community involvement, and even opens up the possibility of earning rental income.

While it does come with more responsibility and work compared to renting, the long-term advantages, such as financial security and a sense of ownership, make it a worthwhile investment for many people.

FAQs

What are the advantages and disadvantages of home?

Owning a home gives stability, security, and lets you build value. You can personalize your space without asking a landlord. Plus, you get tax benefits like deductions on mortgage interest and property taxes. But it means you’re responsible for paying the mortgage, taxes, and upkeep. Selling can take time, and property values can change, affecting your investment. Still, many think the benefits of owning a home are worth it for stability and financial security.

What is the meaning of home ownership?

Homeownership refers to owning a property, typically a house, where you live. It involves purchasing a home using a mortgage or other financing, and then taking responsibility for maintaining and managing the property.

Why is it important to have a house?

Having a house provides shelter and security, which are fundamental human needs. It offers a stable and comfortable living environment for you and your family. Additionally, owning a home can be a valuable investment that helps build wealth over time.

Why having your own property is important?

Having your own property gives you a sense of independence and control over your living situation. It provides a place where you can create memories, build relationships, and establish roots within a community. Furthermore, homeownership can serve as a source of pride and accomplishment, representing a significant milestone in your life.

Mortgage Maestro Group – NMLS #1838215