Did you know the U.S. real estate market is expected to be worth an astounding $119.80 trillion by 2024? Among the different segments, residential real estate is set to lead, with a projected value of $94.39 trillion. Even more impressive, the market is anticipated to grow steadily at 4.51% annually from 2024 to 2028, reaching $142.90 trillion by 2028.

Higher interest rates can be a concern, especially when there are not enough homes available. They make buying a home more expensive and borrowing more difficult. However, the impact varies across different property markets, creating opportunities for good deals in certain areas and types of homes.

Highlighting key trends and uncovering opportunities for buyers and investors alike. Join us as we explore this exciting and dynamic market poised for remarkable growth.

Knowing About Interest Rates

When you borrow money, you have to pay back more than you borrowed. This extra amount is determined by the interest rate set by the lender. If the interest rate is high, you’ll end up paying back more money over time.

Banks work in a similar way. They borrow money from the U.S. Federal Reserve and then lend it out to people like us, but at higher interest rates. This difference between what they borrow and what they lend it out for is how banks make their profit.

Economic Effects of Rising Interest Rates

To see how higher interest rates affect real estate, let’s see how they affect the whole economy:

1. Borrowing Becomes More Expensive

When interest rates rise, it costs more to borrow money for things like credit cards and loans. This makes people less likely to borrow money, leading to reduced spending. Also, those who already have loans will have to spend more on monthly repayments, leaving them with less money to spend on other things.

Since March 2020, when the Fed began raising interest rates, the typical interest rate for credit cards has gone up from around 16% to almost 21%, as per information from Bankrate.

2. People Save Money Rather Than Spend It

When things are uncertain with the economy or when interest rates go up, people usually save more money. For instance, during the COVID-19 pandemic, Americans saved a lot – over 33% of their income in April 2020, according to the U.S. Bureau of Economic Analysis.

Although borrowing becomes more expensive, higher interest rates make saving in bank accounts more rewarding. It’s wiser to hold onto cash in the bank rather than spending it.

3. The Value Of A Currency Rises

Did you know? when a currency’s value rises, it’s a mixed blessing? It signals economic stability but can also hike export prices, affecting global competitiveness.

Countries might get more money in their banks because they offer higher interest rates. This can make their currency more wanted, making its value go up. But this can also make their exports pricier, which might lower the money they make from selling things to other countries.

4. Lower Consumption And Investment

Imagine you usually spend $100 each week on groceries, but suddenly, the interest rates go up. Now, you notice that your credit card interest rates have increased, making your monthly payments higher. To manage this extra cost, you decide to cut back on non-essential spending, like dining out or buying new clothes.

As a result, you reduce your weekly grocery budget to $80 to offset the increased credit card payments.The rise in rates won’t just limit personal spending; it’s probable that businesses will also cut back on investments because they’re less confident in the economy.

5. Government Interest Payments Increase

Countries also borrow money. If a country’s interest payments go up, it might mean taxes will also increase in the future. Higher interest rates can significantly impact government budgets by increasing the costs associated with servicing existing debt. According to the U.S. Treasury Department, interest payments on the national debt totaled over $300 billion in fiscal year 2020.

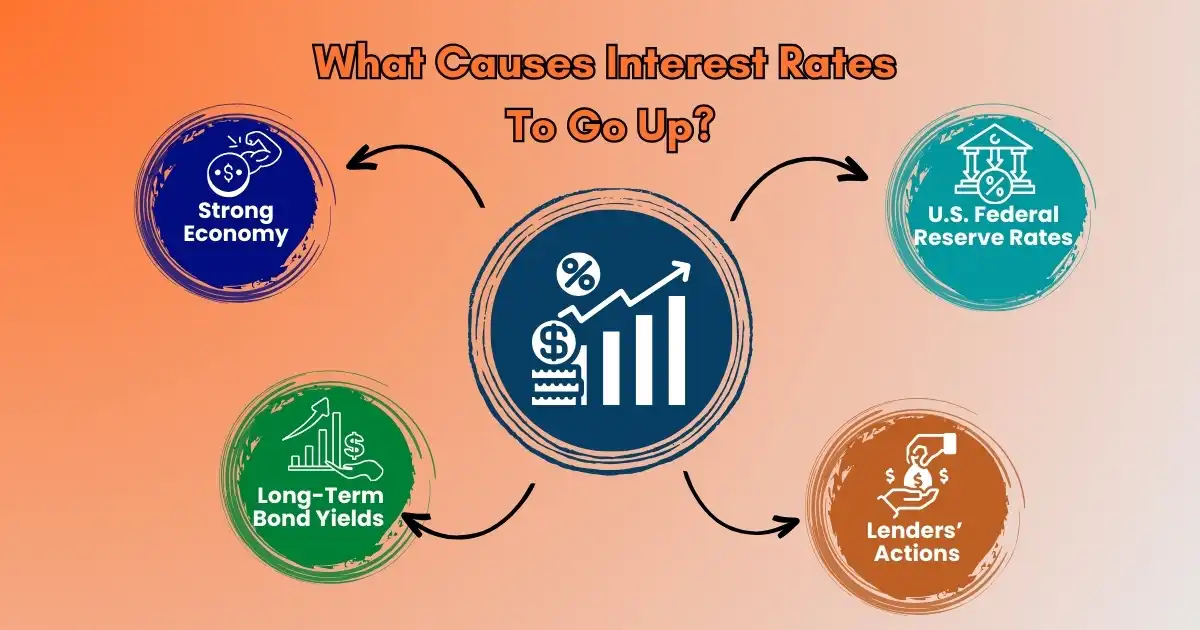

What Causes Interest Rates To Go Up?

Many things affect how interest rates go up in the U.S, such as:

A Strong Economy

When things are going well with money and the government thinks prices will go up, the central bank usually makes borrowing money more expensive by raising interest rates. This means people have less money to spend. As a result, they spend less, and this can slow down the economy, making things more stable.

U.S. Federal Reserve Rates

Banks and financial companies make money by charging people and businesses more interest than what they pay to borrow from the U.S. Federal Reserve. So, if the government raises its lending rate, the rates for loans to the public also go up.

Relationship With Long-Term Bond Yields

Mortgage rates often move with long-term bond yields, like the 10-year Treasury yield. Experts think the recent increase happened because of positive news about vaccines from the White House and the House of Representatives approving extra payments. This made investors leave the bond market, causing interest rates to rise.

Lenders’ Actions

Sometimes, lenders increase borrowing costs because of special circumstances. In 2020, when many people wanted to refinance their mortgages and rates dropped a lot, lenders got too busy. They couldn’t handle all the applications, so some raised their rates to slow down applications and catch up.

Effect Of Rising Interest Rates On The Housing Market

When interest rates go up, it impacts the real estate industry, including buying, selling, and investing in property. Let’s see how it affects each group involved:

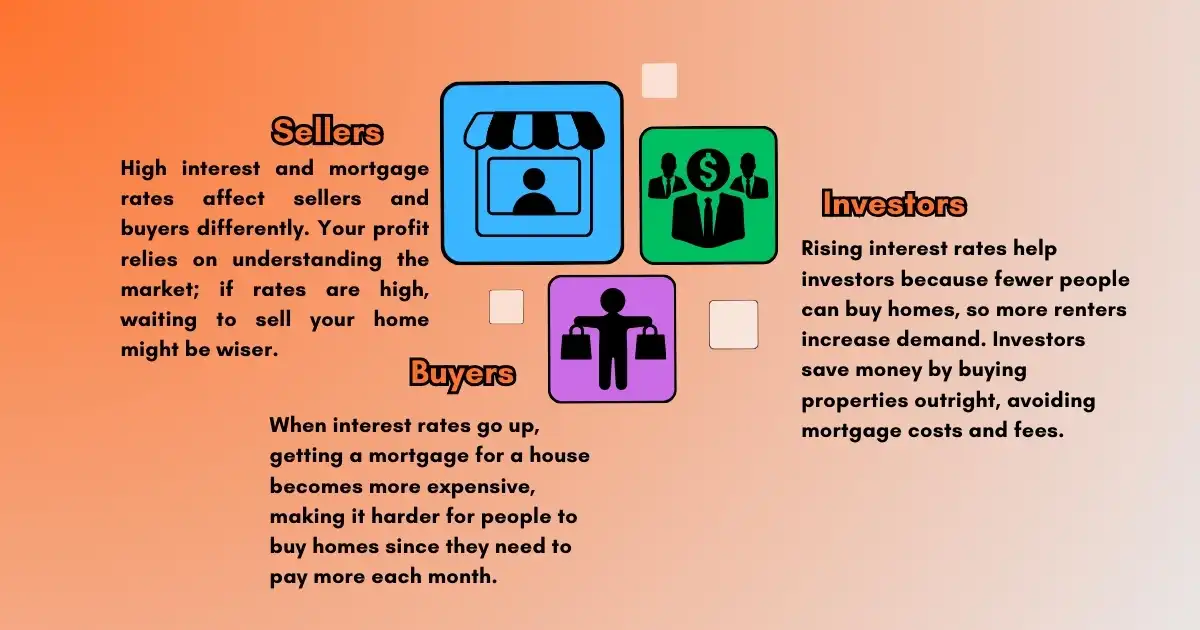

Sellers

Interest rates and mortgage rates impact sellers and buyers differently. Imagine you want to sell your house for a million pesos. You can list it for that amount, but buyers might only afford 950,000 pesos because of high-interest rates.

You’ll still make a profit, but even a small increase in mortgage rates, like just 1%, could lower your home’s value by about 50,000 pesos. So, your profit depends on how well you understand the market. If interest rates are high, it might be better to wait before selling your home.

Buyers

When interest rates go up, getting a mortgage to buy a house becomes more expensive. This means it’s harder for people to afford a home because they have to pay more each month.

But if you choose a fixed-rate mortgage, your monthly payments stay the same for many years, even if interest rates rise. This can help you budget better and make owning a home more manageable.

Investors

Rising interest rates benefit investors as fewer people can afford to buy homes, leading to a growing rental market. Investors avoid mortgage costs and fees by purchasing properties outright.

Buying real estate during rising rates can be wise due to increased supply and decreased demand. Additionally, investors can convert properties into short-term rentals for potential high returns.

Mastering High Interest Rates on the Housing Market

Understanding how high interest rates impact housing markets is important for anyone involved in buying, selling, or investing in real estate. These rates affect the cost of purchasing a home and getting a loan, and they vary across different regions and types of properties.

Explore the impact of high interest rates on housing markets with Mortgage Maestro Group. Whether you’re buying, selling, or investing, knowing these effects is important. Schedule a consultation today for expert guidance on navigating high interest rates’ effects on the housing market!

Final Thoughts

How High Interest Rates Impact Housing Markets? When interest rates rise, it affects the housing market in many ways. Buyers may struggle to afford homes with higher mortgage rates, leading to lower offers from sellers. However, investors can profit from a growing rental market. Understanding how interest rates impact the housing market helps everyone make better decisions.

Additionally, it’s important to consider how rising interest rates affect sellers, buyers, and investors in the housing market. Sellers may need to adjust home prices, while buyers may seek government assistance or alternative payment methods. Investors may find opportunities in renting out properties as buying homes becomes more challenging.

FAQs

Why do high interest rates affect housing markets?

High interest rates can make it more expensive to borrow money for a mortgage, which can reduce the number of people able to buy homes and lead to fewer sales.

What happens when interest rates rise?

When interest rates go up, some potential buyers may delay buying a home because it becomes more costly. This can result in an oversupply of homes for sale.

How do high interest rates affect home prices?

High interest rates can lead to lower demand for homes, which may cause prices to decrease as sellers compete for buyers.

Who benefits from high interest rates in the housing market?

While high interest rates can be challenging for buyers, they can provide opportunities for first-time buyers and those with savings, as lower demand may result in more affordable housing prices.

Mortgage Maestro Group – NMLS #1838215