Not all people looking to buy a home can manage to pay the typical 20% down payment upfront. For many Americans, gathering enough money for a big down payment on a mortgage is tough. But don’t worry, your dream home might still be possible.

In situations like this, buyers can buy their home with mortgage insurance. This insurance helps lenders protect themselves from losing money if the buyer can’t pay back the loan. It’s a normal expense, but it won’t last forever.

It’s a good idea to talk to a financial advisor to make sure your mortgage fits well with your financial plans.

What Is Mortgage Insurance?

“Mortgage insurance is like a safety net for lenders if someone can’t pay back their home loan,it helps the lender by paying off some of what’s still owed on the loan.” explained Brian Quigley, a mortgage broker from Colorado.

In the past, putting down 20% for a home was hard for lots of buyers. Also known as MI, private MI, or PMI, helps people get past that challenge. It’s usually needed for home loans where the down payment is less than 20% of the property’s value.

This insurance protects the lender and lowers the risk of losing money if the borrower doesn’t pay back their mortgage loan.

How Much Is Mortgage Insurance?

The name and price of mortgage insurance can change depending on the type of mortgage you have. The cost differs as well. So, how much does mortgage insurance cost? It depends on a few things:

- Down Payment: If you put down a larger down payment, you might pay less for mortgage insurance. That’s because the more money you put down upfront, the less risky you seem to lenders.

- Loan Amount: The amount of your loan also affects the cost. Generally, the higher your loan amount, the more you’ll pay for insurance.

- Credit Score: Your credit score plays a role too. If you have a higher credit score, you might get a lower rate for mortgage insurance. Lenders see borrowers with good credit scores as less risky.

- Type of Mortgage Insurance: There are different types, like private mortgage insurance (PMI) for conventional loans, mortgage insurance premiums (MIP) for FHA loans, and guarantee fees for USDA loans.

- Private Mortgage Insurance (PMI): This is typically required for conventional loans when the down payment is less than 20%. The cost can vary based on factors like down payment amount, loan amount, and credit score.

- Mortgage Insurance Premiums (MIP): FHA loans require MIP, which includes an upfront fee and ongoing annual premiums. The upfront fee is usually 1.75% of the loan amount, while the annual premiums can vary based on factors like loan amount and loan-to-value ratio.

- Guarantee Fees for USDA Loans: USDA loans also require a guarantee fee, which includes an upfront fee and an ongoing annual fee. The upfront fee is 1% of the loan amount, and the annual fee is 0.35% of the loan balance.

How Do You Pay?

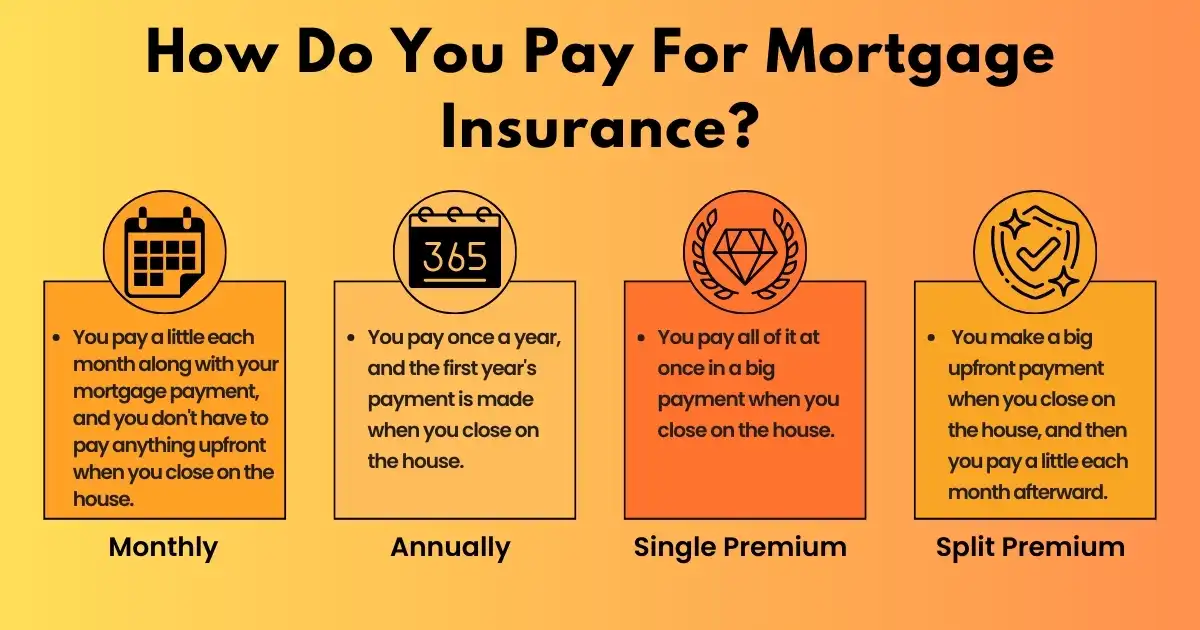

When you have mortgage insurance, you typically have to pay for it as the borrower, even though there are some cases where the lender pays for it. The premiums, or payments, can be made in different ways:

- Monthly: You pay a little each month along with your mortgage payment, and you don’t have to pay anything upfront when you close on the house.

- Annually: You pay once a year, and the first year’s payment is made when you close on the house.

- Single Premium: You pay all of it at once in a big payment when you close on the house.

- Split Premium: You make a big upfront payment when you close on the house, and then you pay a little each month afterward.

With conventional loans, you can pick how you want to pay. But for government-backed loans, like FHA loans, there are set ways you have to pay.

Understanding Mortgage Insurance Costs

Mortgage insurance, or MI, is a key factor in home buying, especially if your down payment is less than 20%. Wondering about the expenses? Let’s break it down together. Understanding it helps you make informed decisions about your mortgage. We’re here to simplify the process for you. Send us an email today and let’s explore your options.

Final Thoughts

Understanding how much mortgage insurance costs and how it works is essential for homebuyers, especially those with smaller down payments. By considering factors such as down payment size, credit score, and loan type, borrowers can make informed decisions about their insurance options and explore strategies to minimize or eliminate this additional expense.

Remember, homeowners are safeguarded by the Homeowners Protection Act, also known as the PMI Cancellation Act, which prevents them from paying too much for PMI. This means you won’t have to pay for PMI forever. So, even if you’re currently paying it along with your regular mortgage payments, you can take steps to stop paying this extra fee. By saving up for a down payment, you might not even need to worry about.

FAQs

How is mortgage insurance calculated?

M.I is figured out as a part of your loan amount. It depends on things like what type of loan you have, how much you’re borrowing, the size of your down payment, how good your credit is, and other similar factors.

Can mortgage insurance be removed?

You can stop paying on some loans. With a regular loan, once you own 20% of your home, you can ask to stop paying. If you have a loan from the government, like FHA, refinancing to a regular loan might be the best way to stop paying insurance.

Are there ways to reduce costs?

You can lower how much you pay by putting down more money upfront. Since the insurance cost is based on a percentage of your loan, having a smaller loan means you’ll pay less for insurance.

What are the two most common types?

The two main types, Private Mortgage Insurance (PMI) and Mortgage Insurance Premium (MIP). PMI is necessary for conventional loans with down payments under 20%, while MIP is required for government-backed loans like FHA and USDA loans. Both types protect lenders if borrowers default on their loans.

Mortgage Maestro Group – NMLS #1838215